- Locations

- Asia Pacific

- From ‘Silver Tsunami’ to ‘Golden Momentum’: Embracing Active Ageing

In a world marked by a significant shift in population distribution towards older ages, countries are experiencing varying paces and degrees of ageing, with the epicentre of ageing shifting from Europe to East and Southeast Asia (SEA)[1]. As countries navigate through the demographic transition, our perceptions of ageing and its societal impacts are also undergoing a profound change.

The New Silver Tsunami?

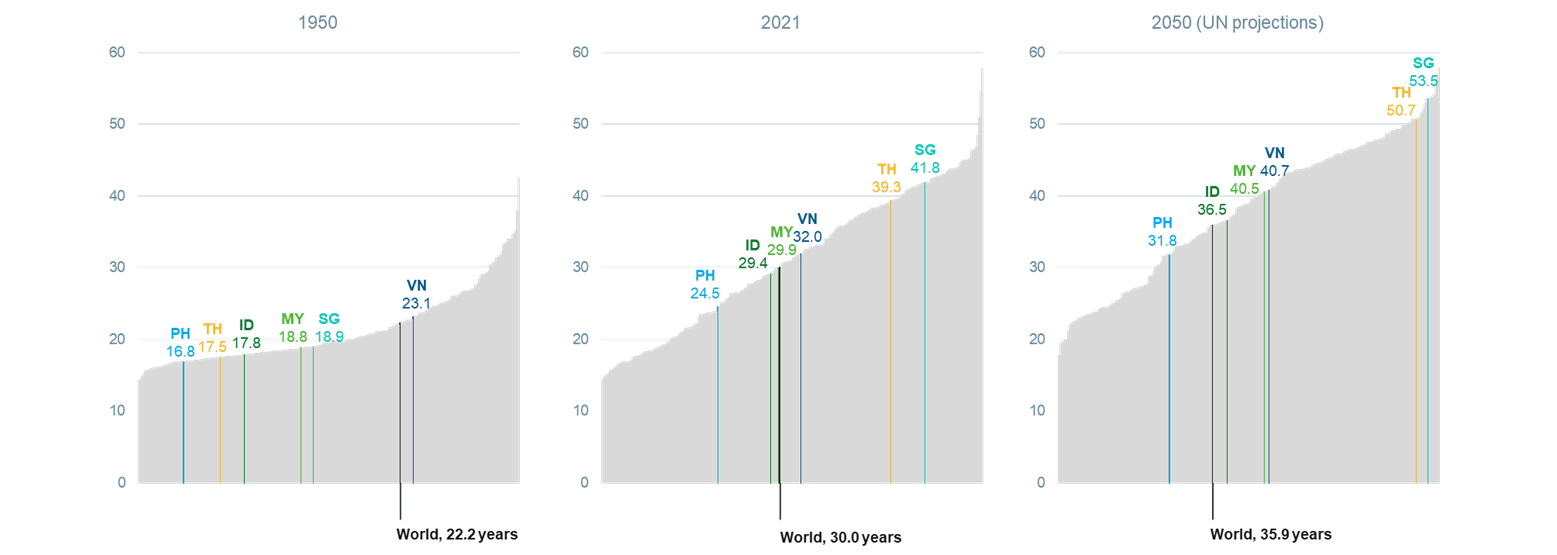

The profound ageing transition within SEA is evident through a significant rise in the median ages of its populations (Exhibit 1). In 1950, the median ages in SEA were below the global median, but a century later they are projected to shift to the right of the global median.

Exhibit 1: Countries ranked by their median age (years)

Median age depicts the age distribution of a population, splitting it into two groups of equal size, i.e., there are as many people with ages above the median age as there are with ages below.

Each vertical line in the chart represents a country; 1950 to 2021 charts show historical estimates, for 2050 chart the UN projections (medium variant) are shown.

Data source: United Nations, World Population Prospects (2022); reference source: ourworldindata.org

And amidst this transformation lies a narrative often overshadowed by an arguably controversial term ‘Silver Tsunami’[2,3], used to depict the demographic ‘wave’ that sweeps across social, economic, and healthcare landscape. Undeniably, the trends of declining fertility rates and increased life expectancy pose great demographic challenges for many countries – a shrinking workforce with economic repercussions, a growing burden of chronic diseases on older adults, and the struggles to offer adequate benefits (e.g., pension, healthcare coverage) for their citizens[4].

Redefining Ageing – The Power of ‘Golden Momentum’ in Active Ageing

However, focusing solely on the concept of countries paying a ‘demographic tax’ is a limited and narrow perspective. After all, population ageing signifies a collective triumph in improving the living conditions worldwide, more notably in this region. This success can be attributed to several factors, from advances in education, improved essential health services to empowerment of women[5]. These elements have likely contributed to a multitude of positive aspects of active and engaged ageing, as illuminated by IQVIA GoldenTrack.

When assessing self-perceived well-being, a positive state of which quality of life and aspects of physical, mental, and social conditions are encompassed, individuals aged 60 and above (termed ‘active agers’) consistently exhibit significantly higher scores than their counterparts aged 45 to 59 (designated as ‘pre-active agers’). Such discrepancy is closely tied to distinct levels of satisfaction across multiple key aspects of life, including financial stability and security, improved living conditions and greater autonomy in time management, all of which are associated to a higher satisfaction amongst the active agers.

They also actively engage in various health-enhancing behaviours and are eager adopters of health technology and tracking devices, with 5 in 6 reported using some forms of healthcare devices in current times (e.g., fitness tracker/apps have a 43% active user rate amongst the consumers in Singapore).

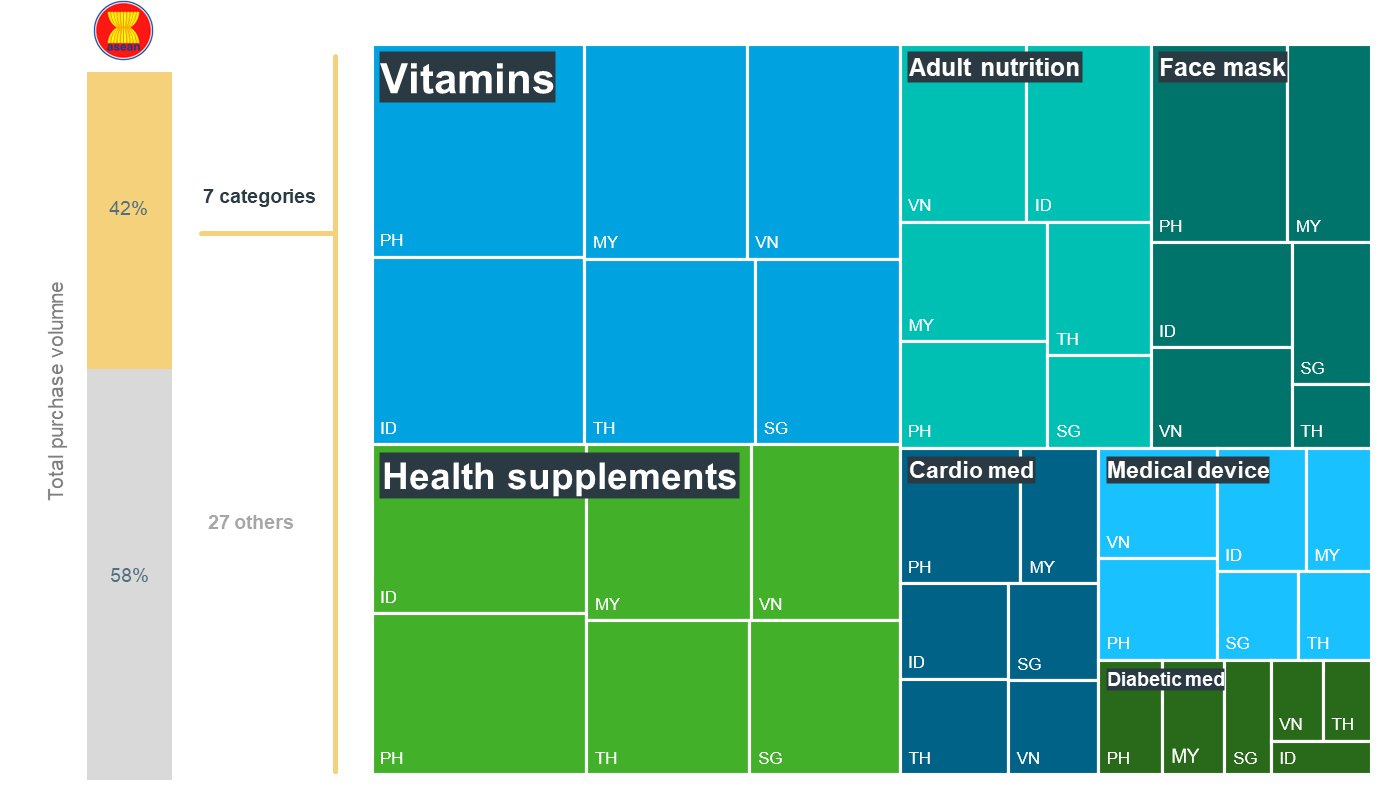

The increasing emphasis on holistic and preventive health management is further evident through consumers’ willingness to invest in their health as reflected in their significant purchases of healthcare products (Exhibit 2).

Exhibit 2: Past-3-month healthcare product purchase

Products purchase incidence (%; relative volume) – only selected categories are shown here

GoldenTrack Base: N = 4002: Q18.[CATEGORY PURCHASE P3M] Which of these products have you purchased in the past 3 months?

Some notable callouts include:- 7 in 10 purchase vitamin supplements in Indonesia

- In Malaysia and Thailand, active agers have a higher rate of health supplement purchases (>50%) than their younger counterparts (~30%)

- ~1 in 2 of consumers purchase health masks in the Philippines, which is the highest across Southeast Asia

- 40% of the shoppers in Vietnam and Indonesia have adult nutritional milk on their list

Nonetheless, purchasing behaviours appear highly homogeneous across SEA – vitamins, minerals, and health supplements are included in the shopping list of many, underscoring the ever-growing relevance and importance of self-care in the region.

By reaping the ‘longevity dividend’, older adults in SEA are transforming our perceptions of ageing, challenging the traditional view of the silver tsunami as a destructive force. They are leading healthier lives than ever before, readily embracing proactive and preventive attitude towards health management. Fuelled by the ‘Golden Momentum’, they exemplify health-conscious living, showcasing the potential of increased life expectancy. In what ways would the society benefit if we all adopted a proactive health-oriented mindset?

For more information on IQVIA GoldenTrack insights across markets, please feel free to contact us or click here to find out more.

References

[1] UN, Department of Economic and Social Affairs

[2] Barusch, Amanda (2013). Journal of Gerontological Social Work.

[3] Robert Kramer, https://blog.nic.org/silver-tsunami

[4] Adapted from World Bank and Asian Development Bank (ADB)

[5] Adapted from UN World Social Report 2023