-

Americas

-

Asia & Oceania

-

A-I

J-Z

EMEA Thought Leadership

Developing IQVIA’s positions on key trends in the pharma and life sciences industries, with a focus on EMEA.

Learn more -

Middle East & Africa

EMEA Thought Leadership

Developing IQVIA’s positions on key trends in the pharma and life sciences industries, with a focus on EMEA.

Learn more

Regions

-

Americas

-

Asia & Oceania

-

Europe

-

Middle East & Africa

-

Americas

-

Asia & Oceania

-

Europe

Europe

- Adriatic

- Belgium

- Bulgaria

- Czech Republic

- Deutschland

- España

- France

- Greece

- Hungary

- Ireland

- Israel

- Italia

EMEA Thought Leadership

Developing IQVIA’s positions on key trends in the pharma and life sciences industries, with a focus on EMEA.

Learn more -

Middle East & Africa

EMEA Thought Leadership

Developing IQVIA’s positions on key trends in the pharma and life sciences industries, with a focus on EMEA.

Learn more

SOLUTIONS

-

Research & Development

-

Real World Evidence

-

Commercialization

-

Safety & Regulatory Compliance

-

Technologies

LIFE SCIENCE SEGMENTS

HEALTHCARE SEGMENTS

- Information Partner Services

- Financial Institutions

- Public Health and Government

- Patient Associations

- Payers

- Providers

THERAPEUTIC AREAS

- Cardiovascular

- Cell and Gene Therapy

- Central Nervous System

- GI & Hepatology

- Infectious Diseases and Vaccines

- Oncology

- Pediatrics

- Rare Diseases

- View All

Impacting People's Lives

"We strive to help improve outcomes and create a healthier, more sustainable world for people everywhere.

LEARN MORE

Harness the power to transform clinical development

Reimagine clinical development by intelligently connecting data, technology, and analytics to optimize your trials. The result? Faster decision making and reduced risk so you can deliver life-changing therapies faster.

Research & Development OverviewResearch & Development Quick Links

Real World Evidence. Real Confidence. Real Results.

Generate and disseminate evidence that answers crucial clinical, regulatory and commercial questions, enabling you to drive smarter decisions and meet your stakeholder needs with confidence.

REAL WORLD EVIDENCE OVERVIEWReal World Evidence Quick Links

See markets more clearly. Opportunities more often.

Elevate commercial models with precision and speed using AI-driven analytics and technology that illuminate hidden insights in data.

COMMERCIALIZATION OVERVIEWCommercialization Quick Links

Service driven. Tech-enabled. Integrated compliance.

Orchestrate your success across the complete compliance lifecycle with best-in-class services and solutions for safety, regulatory, quality and medical information.

COMPLIANCE OVERVIEWSafety & Regulatory Compliance Quick Links

Intelligence that transforms life sciences end-to-end.

When your destination is a healthier world, making intelligent connections between data, technology, and services is your roadmap.

TECHNOLOGIES OVERVIEWTechnology Quick Links

CLINICAL PRODUCTS

COMMERCIAL PRODUCTS

COMPLIANCE, SAFETY, REG PRODUCTS

BLOGS, WHITE PAPERS & CASE STUDIES

Explore our library of insights, thought leadership, and the latest topics & trends in healthcare.

DISCOVER INSIGHTSTHE IQVIA INSTITUTE

An in-depth exploration of the global healthcare ecosystem with timely research, insightful analysis, and scientific expertise.

SEE LATEST REPORTSFEATURED INNOVATIONS

-

IQVIA Connected Intelligence™

-

IQVIA Healthcare-grade AI™

-

Human Data Science Cloud

-

IQVIA Innovation Hub

-

Decentralized Trials

-

Patient Experience powered by Apple

WHO WE ARE

- Our Story

- Our Impact

- Commitment to Public Health

- Code of Conduct

- Environmental Social Governance

- Privacy

- Executive Team

NEWS & RESOURCES

Unlock your potential to drive healthcare forward

By making intelligent connections between your needs, our capabilities, and the healthcare ecosystem, we can help you be more agile, accelerate results, and improve patient outcomes.

LEARN MORE

IQVIA AI is Healthcare-grade AI

Building on a rich history of developing AI for healthcare, IQVIA AI connects the right data, technology, and expertise to address the unique needs of healthcare. It's what we call Healthcare-grade AI.

LEARN MORE

Your healthcare data deserves more than just a cloud.

The IQVIA Human Data Science Cloud is our unique capability designed to enable healthcare-grade analytics, tools, and data management solutions to deliver fit-for-purpose global data at scale.

LEARN MORE

Innovations make an impact when bold ideas meet powerful partnerships

The IQVIA Innovation Hub connects start-ups with the extensive IQVIA network of assets, resources, clients, and partners. Together, we can help lead the future of healthcare with the extensive IQVIA network of assets, resources, clients, and partners.

LEARN MORE

Proven, faster DCT solutions

IQVIA Decentralized Trials deliver purpose-built clinical services and technologies that engage the right patients wherever they are. Our hybrid and fully virtual solutions have been used more than any others.

LEARN MORE

IQVIA Patient Experience Solutions powered by Apple

Empowering patients to personalize their healthcare and connecting them to caregivers has the potential to change the care delivery paradigm. IQVIA and Apple are collaborating to bring this exciting future of personalized care directly to devices patients already have and use.

LEARN MOREWORKING AT IQVIA

Our mission is to accelerate innovation for a healthier world. Together, we can solve customer challenges and improve patient lives.

LEARN MORELIFE AT IQVIA

Careers, culture and everything in between. Find out what’s going on right here, right now.

LEARN MORE

WE’RE HIRING

"Improving human health requires brave thinkers who are willing to explore new ideas and build on successes. Unleash your potential with us.

SEARCH JOBS- Blogs

- Price growth forecast to slow as patent expiries impact the Diabetes market

Diabetes Market

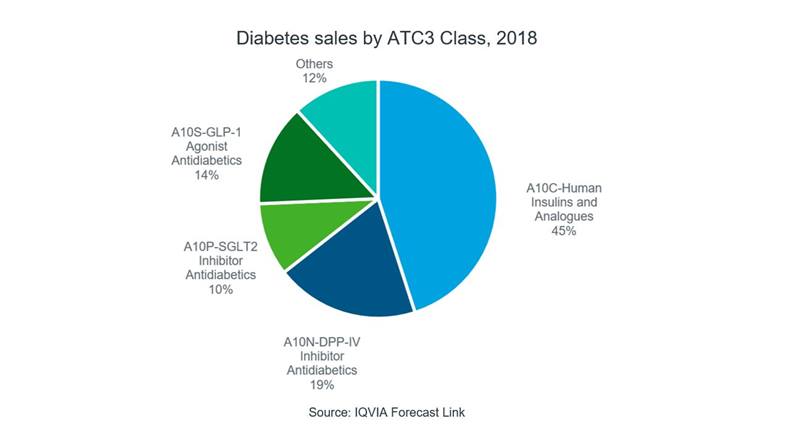

The 2018 diabetes market is estimated to be $87 billion globally. Insulin products create 45% of sales, while newer Glucagon-like peptide-1 (GLP-1) inhibitors and sodium-glucose cotransporter type 2 (SGLT2) inhibitors contribute to a smaller but growing proportion. Total sales are forecast by IQVIA’s Forecast Link to grow minimally with a 2% growth rate (CAGR) over the 10-year forecast period (2018-2028).

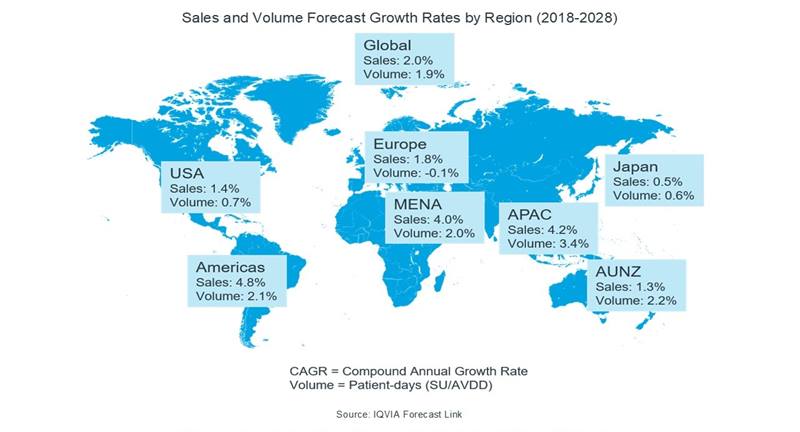

Regional Diabetes Sales and Volume

The USA is the biggest market for diabetes and will continue to dominate to 2028, accounting to $65.2 billion due to high cost of treatment. Diabetes sales in the USA is expected to grow at a CAGR of 1.4% from 2018 to 2028, but will remain flat in terms of volume growth, indicating that price growth drives the market in this region. In fact, apart from Japan and AUNZ, regional sales growth exceeds volume growth signifying a similar trend globally.

APAC regions show the highest growth in the volume of diabetes drugs used, most likely due to the increasing ‘westernization’ of diet in the region which has been linked to increased type 2 diabetes.

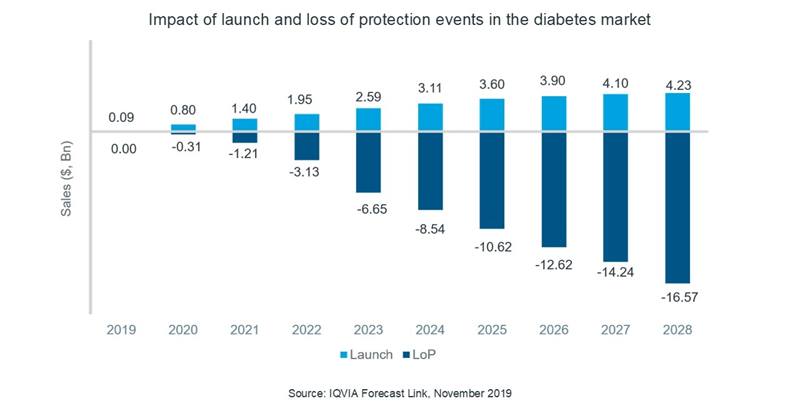

Growth due to new launches overshadowed by the loss of protection events

IQVIA forecast the launch of 10 new pipeline products in upcoming years but the effect of these launches on total market sales is outweighed by dramatic reductions in sales due to generic competition for key brands. Over the forecasted period, DPP-IV inhibitors will show most erosion by generics followed by SGLT-2 inhibitors.

Recent decisions by the US FDA have also reduced the impact of new launches. For example, the FDA declined to approve two SGLT2 treatments for additional use in type 1 diabetes, despite both these molecules (dapagliflozin and sotagliflozin) being approved this year in Europe for type 1. Most recently the FDA advisory committee has voted against approval of another SGLT2 treatment for type 1 diabetes, which looks likely to be the third drug in the class to be rejected by the agency.

Price growth continues, but increased resistance emerging

IQVIA forecasts that the diabetes market will see positive price growth between 2018 and 2028 in all regions except Japan and AUNZ on an average implied price basis ($/patient-day). The average growth will be greatest in South America at 6.6%, likely driven by high inflation rates here, while North America will experience the slowest positive growth at 0.7%. Average prices are expected to decrease in Japan and AUNZ at a CAGR of -2.0% and -0.3%, respectively. Globally, the average price for diabetes treatments will grow at a CAGR of +0.2%.

Recent criticism over high insulin prices from media and public sources have led to increased pressure on insulin manufacturers, particularly in the USA. Biosimilar launches are beginning to combat this. For example, one company is launching an authorized biosimilar of their own insulin aspart product in January 2020, before loss of patent protection and at 50% of the originator brand price, to allow access to lower priced insulin to those that need it. This is accounted for in the IQVIA Forecast Link tool and contributes to the lower sales growth in the USA.

Diabetes is a significant area of innovation in new drug treatment, and the launch of novel and improved GLP-1 inhibitors drives some of the growth seen in the market. For example, there is particular interest in a new mechanism just entering clinical trials which involves encapsulating a human cell line that has been genetically engineered to produce and release insulin in response to the levels of blood sugar in the human body. The encapsulated cells are implanted in a diabetic patient where the aim is that they will function as a “bio-artificial pancreas” and will produce insulin when needed. This and other innovative options have the potential to transform the diabetes market and offer exciting opportunities for patients.

The Forecast Link online tool provides 10 year forecasts for an unrivalled breadth of disease and country coverage, and is updated quarterly. To find out more, please view the Forecast Link video

For individual disease data extracts please see Forecast Link: Disease.

Other blogs from IQVIA Forecast Link: Heart Disease Market Forecasts