About the Report

Emerging biopharma (EBP) companies are at the root of early-stage drug development and their performance, the environment in which they operate, and their relationship to other stakeholders in the health system play a critical role in determining the future of many novel therapies and health technologies. The report provides clarity on the current landscape of EBP companies and their emerging product pipelines, clinical trial activity and levels of trial success. In addition, the report focuses on the financial deals, strategies, and organizational archetypes that lead to EBPs effectively developing and/or marketing novel products, as well as providing an assessment of the overall outlook for EBPs, with a focus on how key trends will shape future achievements.

Report Summary

Emerging biopharma (EBP) is a segment of companies driving a large portion of innovation and development in the life sciences. EBP companies are defined as having less than $200 million in estimated annual spending on R&D, or under $500 million in global revenue. EBP’s encompass 3,212 companies in 2018 and account for 73% of late-stage research, up from 52% in 2003, and the number of molecules under development by EBPs grew by 15% in each of the past two years.

EBPs increasingly contribute to innovation, and these companies were the original patentees for 29 of the current top 100 drugs, which account for 40% of sales in the United States in 2018. For drugs launched in 2018, EBPs originated and launched 42% of the new drugs, up from 26% in 2017. EBP- originated products generally reach the market faster if they were acquired and launched by other company segments, and the median time for EBP companies to launch new drugs was 16.6 years in 2018, over 30% slower than other company segments.

Partnering between EBPs and larger companies accounted for nine of the top ten partnering deals in 2018, and emerging biopharma companies were involved in seven of the top ten M&A deals in 2018. There was also a 78% increase in deals at pre-registration stage, or 62 deals compared with 36 in 2017. Large pharma continues to acquire or license assets between themselves and with EBPs, and in 2018, among 45 companies assessed, 415 deals were transacted for an aggregate disclosed value of $272 billion.

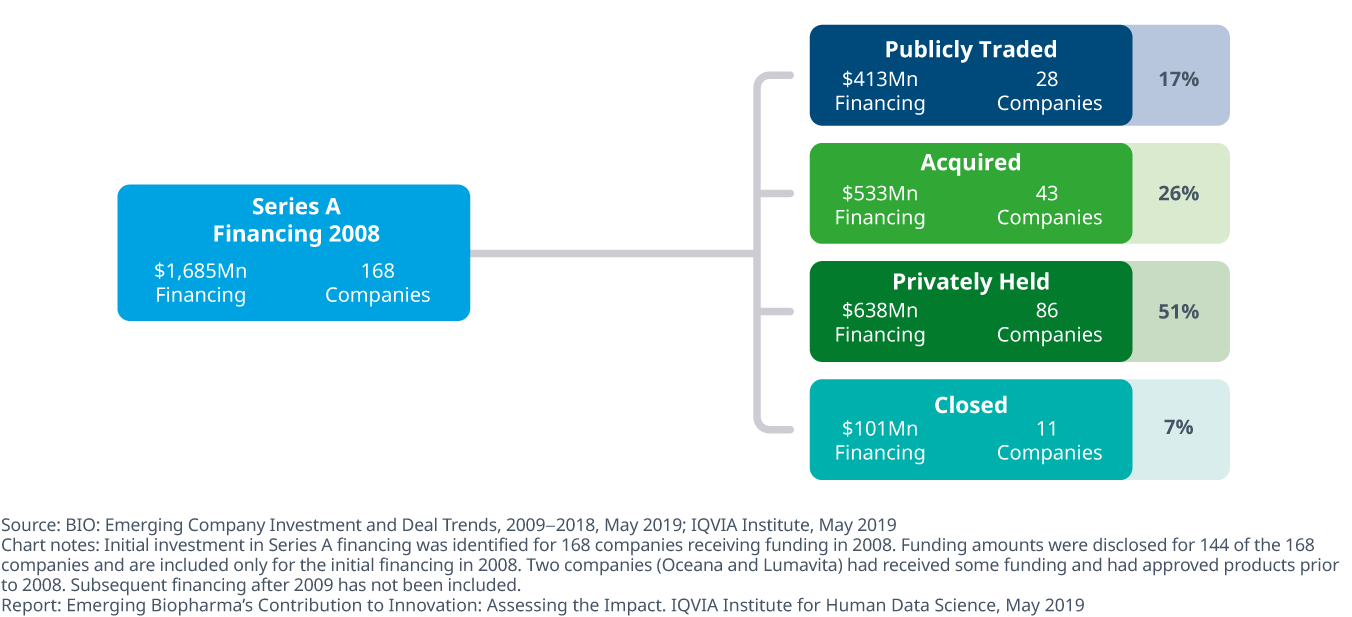

There were 168 startups which received series A funding in 2008, and ten years later these companies have achieved a variety of outcomes, providing a useful benchmark on performance for startups which have received funding more recently. Of these, 51% of companies were privately held and 17% had gone public. Of those 28 publicly-traded companies, five now have market capitalization of over $1 billion dollars.

Over the next five years, EBPs engaged in R&D and commercialization will face a changing environment and need to adapt accordingly. The use of biomarkers in clinical trials will have the greatest impact on EBP clinical development productivity, yielding a 34% increase on average, and pools of pre-screened, which aid in trial recruitment, will lead to an average increase in productivity of 29%. In the next five to ten years, three key attributes will be important for EBPs to embrace to assure their success: the use of data and analytics, the adoption of technology and a critical need to employ flexible business models.

Key Findings

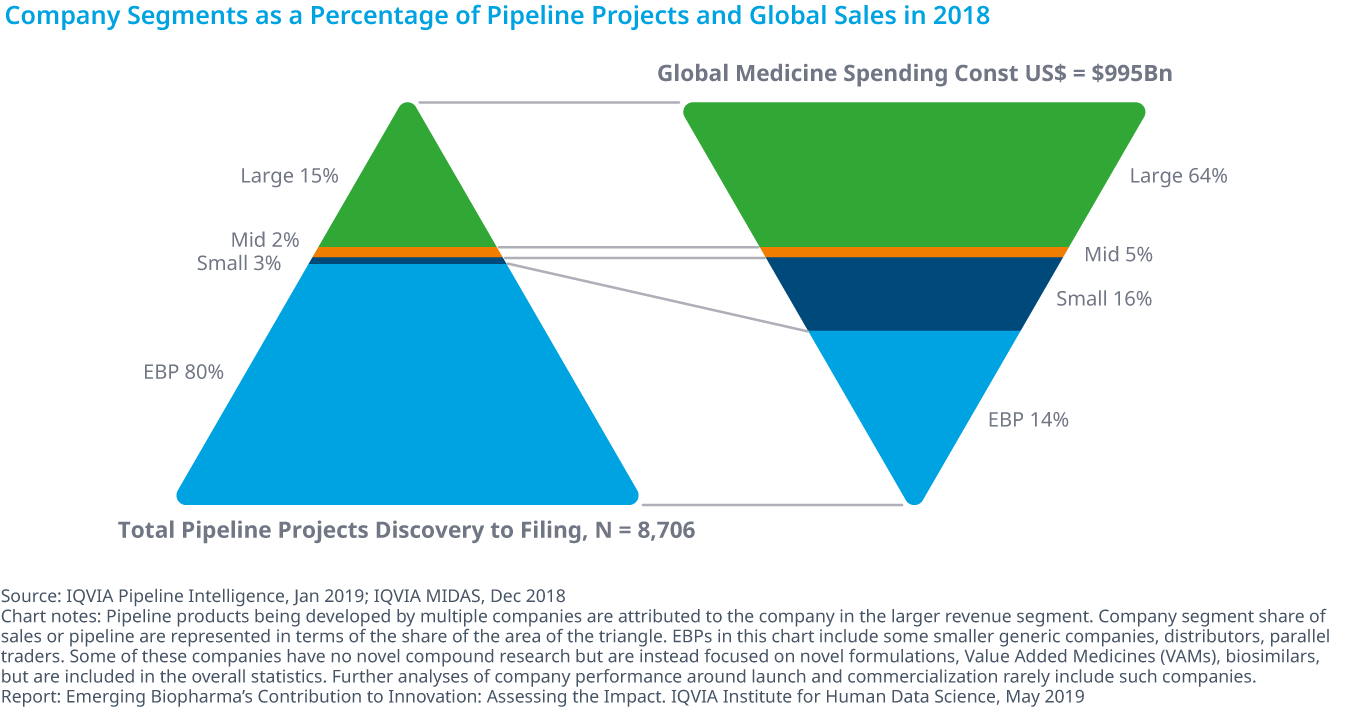

Emerging biopharma companies make up 80% of the total development pipeline and earned 14% of revenue in 2018

- Emerging biopharma companies (EBP) range across a variety of types from pure innovators to companies focused on developing generics, reformulations and biosimilars.

- Including both early-phase and late-phase research, EBP companies account for 80% of R&D activity. More specifically, EBP companies represent 84% of early-phase research and 73% of the late-stage R&D pipeline in 2018.

- The late-stage development pipeline of emerging biopharma has steadily expanded with 15% growth in products in both 2017 and 2018.

- With 8,706 products in active development, ranging from discovery to registration, emerging biopharma are developing treatments that span a diverse range of drug classes.

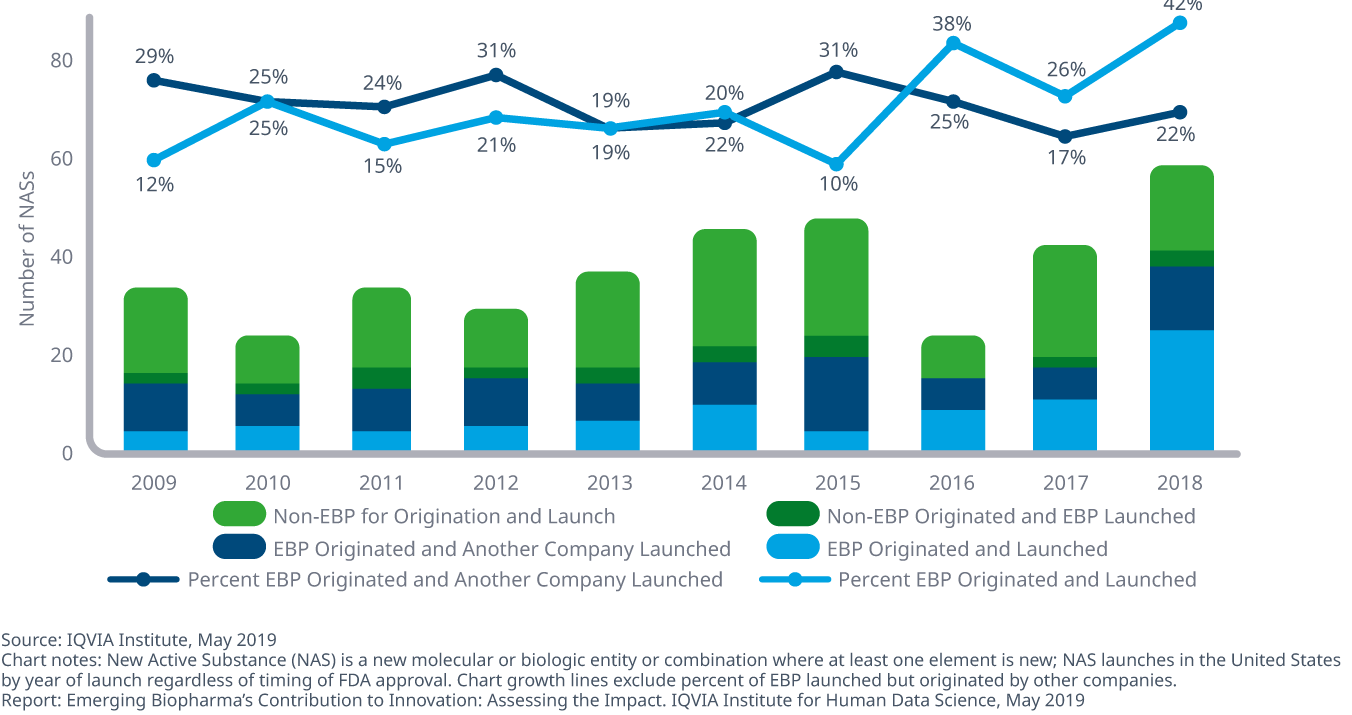

Emerging biopharma companies originated and launched 42% of new drugs 2018, a higher percentage than in past years and up from 26% in 2017

- EBPs increasingly contribute to innovation and have patented 29 of the top 100 drugs, which account for 40% of sales in the United States in 2018.

- Over half of EBP-launched drugs had orphan designation and almost a quarter were approved based on a single-arm trial

- From the time of patent filing, the median time for EBP companies to launch new drugs was 16.6 years in 2018, over 30% slower than other company segments.

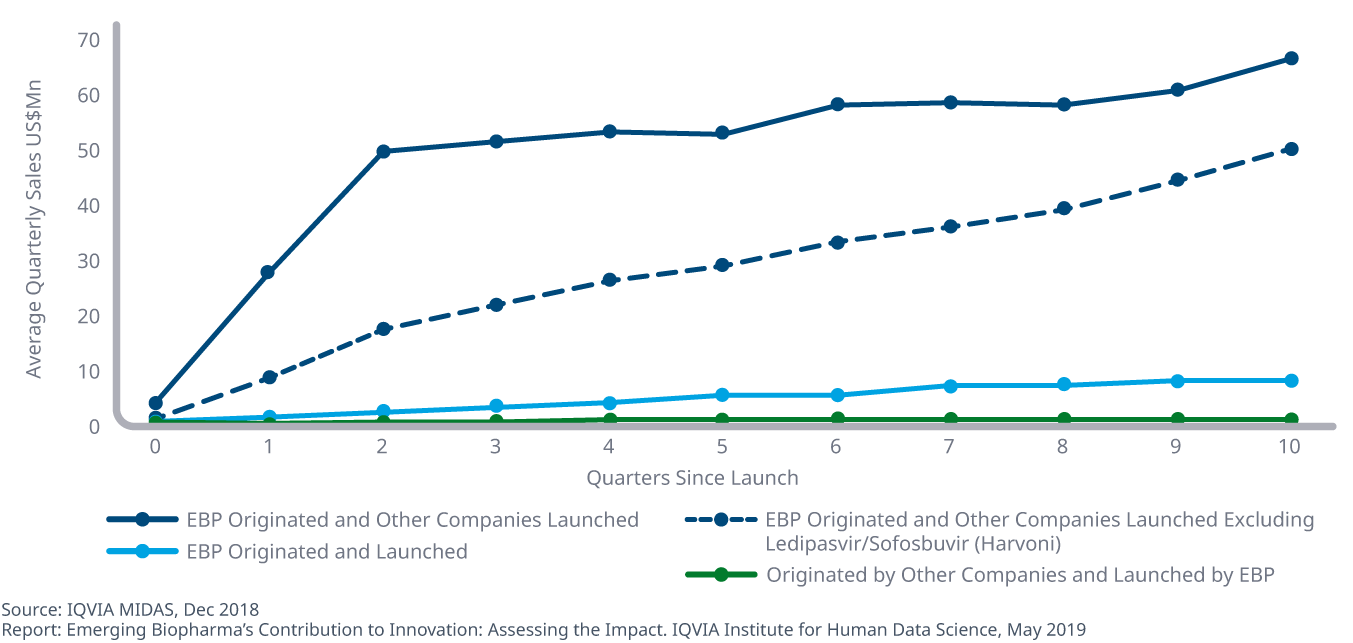

Emerging biopharma companies generally achieve lower average sales when launching new active substances than other companies

- Some of the most successful new drugs of the past five years were discovered by emerging biopharma companies and later launched by larger companies.

- Average quarterly sales uptake one year after launch is 2.6 times higher for larger companies launching EBP-originated products than for emerging biopharma companies that develop and launch their own assets, widening to 6.5 times higher 18 months later.

- Launch performance varies significantly based on unmet need in the market and level of product differentiation.

- For newly-launched active substances originated by EBP companies, more address areas of high unmet need; 69% of EBP originated drugs were focused on areas of high unmet need compared to 65% of drugs from other companies.

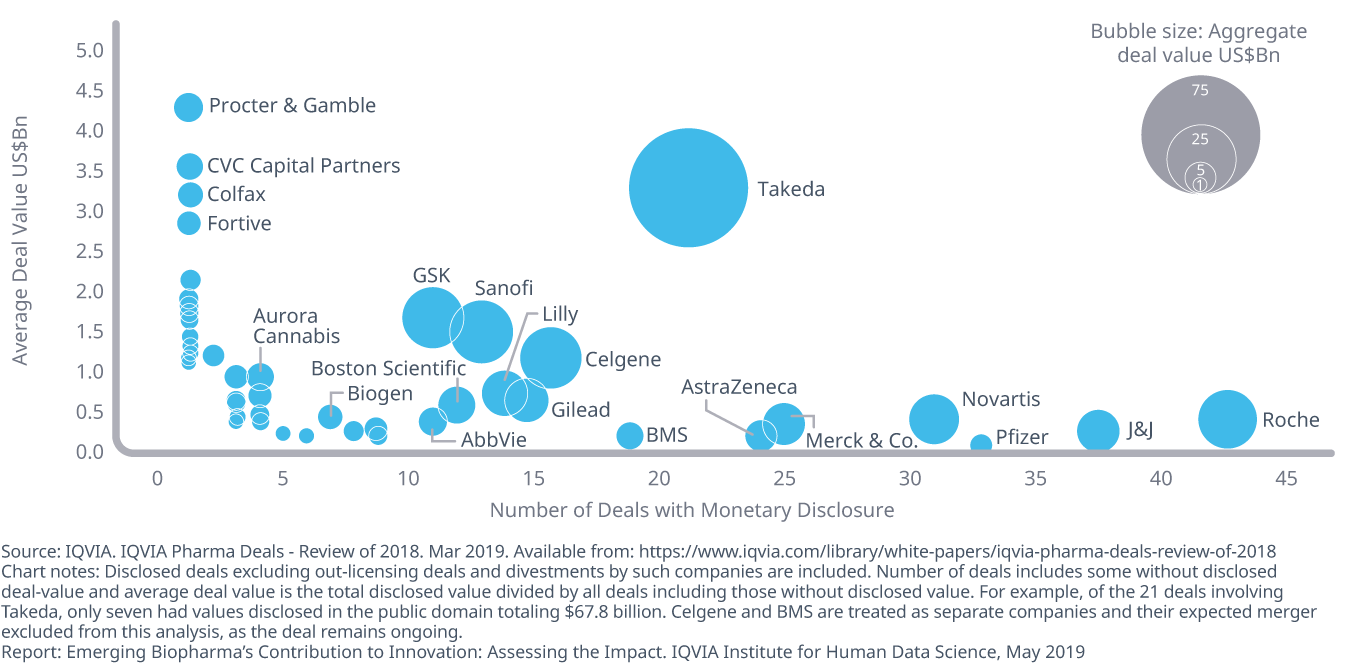

Deals announced in 2018 included 415 in-licensing or in-bound partnership agreements totaling $272 billion in agreed payments

- Large pharma continues to acquire or license assets between themselves and with EBPs. Of the 45 companies assessed, 415 deals were transacted in 2018, for an aggregate disclosed value of $272 billion.

- On average, companies carried out 9.2 deals each, with deals summing to an average of $6 billion per company, and the median deal amount at $2.6 billion.

- The number of disclosed collaborative R&D deals fell by 12% from 2017 to 2018, while the aggregate total value of those deals increased to $47.3 billion, with the mean total deal value increasing 8% in 2018 to $569 million.

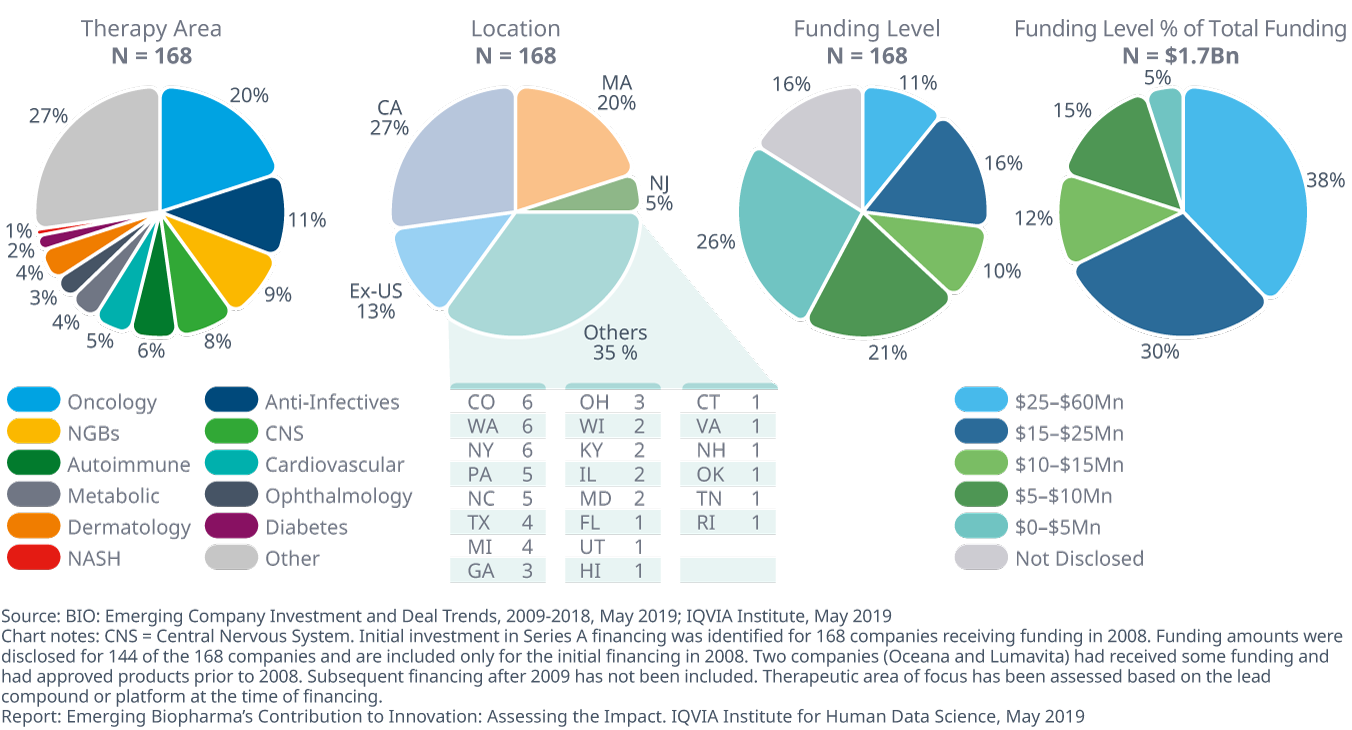

Startups received funding in 2008 across a range of therapy areas and at varied funding levels, with half occurring in three U.S. states

- The 168 companies that received Series A financing in 2008 were focused in a range of therapies, with 87% of that funding U.S.-based, and over half of the companies headquartered in either California, Massachusetts or New Jersey.

- The largest area of focus for these companies was oncology, mirroring its rise in importance to the overall pipeline since 2008.

- 37% of the companies received more than $10 million in 2008, accounting for 80% of total funding.

Since the initial financing, 51% of companies are still privately held, 7% have closed and 26% have been acquired

- Of the 168 companies receiving financing between 2008 and 2009, 28 companies are publicly traded, five of which now have market capitalization of over $1 billion dollars.

- More than half of the 168 companies have compounds in late-stage research and two-thirds of the companies have early-stage research ongoing, with some continuing their initial projects, and others pursuing additional developments begun after funding was received funding.

- 43 companies have been acquired since initial financing with more than half acquired by other emerging biopharma companies.

- Over half of the companies that received financing are still privately owned and 11 of the 168 companies have closed, having failed to progress their research, find a purchaser or find funding streams to continue operations.