- Locations

- Asia Pacific

- Domestic Manufacturing in LMICs Part 2: Building Supply Chain Resilience

In our previous blog post, we explored the valuable lessons learned from the global pandemic response, emphasizing the importance of equitable access, addressing disparities, and fostering resilience. Building upon those lessons, we now turn our attention to a critical aspect of pandemic recovery which is to improve regional and local capacity for vaccine production.

Recognizing the need to reduce reliance on external suppliers and ensure timely access to vaccines, governments of the LMICs and development banks have embarked on ambitious plans to prioritize domestic manufacturing. In this article, we will dive deeper into these efforts, examining the strategies, partnerships, and funding initiatives aimed at scaling up regional and local vaccine production.

Governments and development banks collaborate to boost domestic vaccine manufacturing

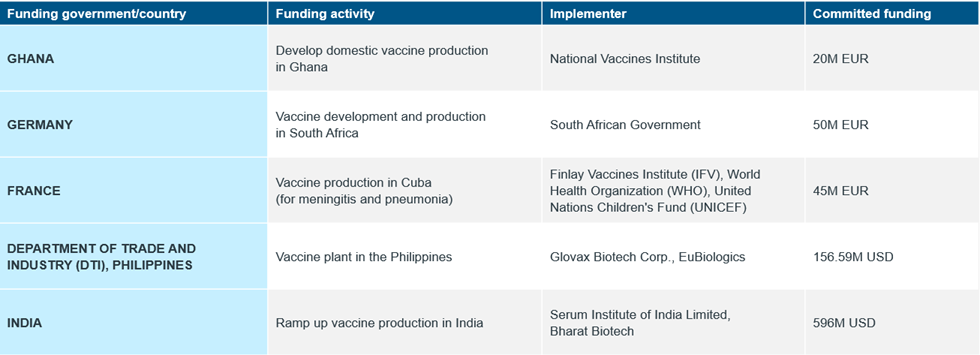

In 2022, in an effort to improve regional and local capacity to scale-up vaccines production, governments announced plans and fundings through bilateral and multilateral partnerships to prioritize domestic vaccines manufacturing1 (Table 1). Development banks also announced major partnerships and huge funding support in the form of loans for regional and domestic vaccines manufacturing2 (Table 2).

Table 1: Committed Funding by Governments for Domestic Vaccines Manufacturing

Table 2: Committed Funding and Partnerships Announcement by the Development Banks for Domestic Vaccines Manufacturing

Strategizing the development of African vaccines manufacturing

Partnerships for African Vaccine Manufacturing (PAVM) was established by the African Union (AU) with the aim of enabling Africa to develop, produce, and supply over 60% of the continent's required vaccine doses by 20403. The Framework for Action (FFA) was then developed to strategize the growth of a sustainable vaccine manufacturing industry in Africa.

The FFA set interim goals of achieving 10% vaccine production by 2025 and 30% by 2030, ultimately aiming for at least 1.5 billion vaccine doses per year by 2040. Africa's vaccine demand is expected to more than double in volume over the next decade, reaching over 2.7 billion doses in 2040. Currently, local African manufacturing accounts for only about 1% of the continent's vaccine demand, with the majority heavily reliant on global providers.

The need for an integrated ecosystem approach is also emphasized, including investment in research and development, drug substance manufacturing, and fill and finish capabilities. The manufacturing of vaccines for 22 critical diseases, including both legacy diseases and emerging and outbreak diseases, are prioritized. Seven vaccine manufacturing technologies are prioritized to provide flexibility to produce the vaccines needed while 23 manufacturing plants are to be established, including integrated drug substance and fill and finish facilities, to achieve the ambitious targets.

PAVM has identified collaboration with multiple stakeholders to deliver on the ambition such as AU member state governments, local and multinational vaccine manufacturers, various AU agencies, Regional Economic Communities (RECs), national regulatory authorities, African Development Finance Institutions (DFIs), African Research Institutions (ARIs), global donors and international organizations.

Indonesia’s health resilience strategy

One of the key areas of Indonesia’s resilience strategy is to transform the domestic pharmaceutical industry. Domestic pharmaceutical companies claim roughly 73% market share in Indonesia4, which makes Indonesia among the few countries in the region that has strong domestic presence. 95% of Indonesia’s drug volume comes from domestic companies, while the remaining 5% are from the multinationals (MNCs). Additionally, 75% of the industry’s value comes from domestic companies and 25 percent comes from the MNCs5.

However, despite this encouraging development, there were some lessons learned during the pandemic. Even though there are 4 state-owned pharmaceutical corporations, 169 Indonesian national private corporations and 35 multi-national corporations operating in Indonesia6, the country still relies on importation for 95% of the active pharmaceutical ingredients (API)7. The API imports are dominated by China (70%) and India (20%), while the remaining shares are from the United States and European Union8. API importation was the preferred choice by the pharmaceutical industry due to lack of standard from the local API suppliers, technology challenges as well as human resources constraints9. During the pandemic, this over-reliance on import has left the Indonesian pharmaceutical industry vulnerable with the global disruption of API supply.

Therefore, the government of Indonesia aims to build domestic manufacturing capabilities to produce API for the top 10 catastrophic diseases and 40 of the most essential medicines, 14 antigen vaccines for the national immunization program (NIP) and COVID-19 vaccines, phytomedicines and biology products. One of the policy changes that was made to attract more investments in local manufacturing of APIs is to allow for 100 percent foreign business ownership in this sector, an increase from the previous 85 percent maximum ownership under the Presidential Decree No. 39/201410. The country also aims to support the B2B transfer of technology via multilateral cooperation with international organizations, especially for the production of viral-vector and nucleic acid-based vaccines11.

Commitment to a sustainable and resilient future

The efforts to improve regional and local capacity for vaccine production are essential for building resilience in the face of future pandemics. Governments have recognized the importance of reducing reliance on external suppliers, creating ambitious plans and sourcing for funding initiatives to prioritize domestic manufacturing. PAVM and Indonesia's health resilience strategy exemplify the commitment in developing a sustainable local vaccines and pharmaceutical manufacturing industry.

In our final blog post of the series, we will explore guiding principles and best practices for establishing and enhancing domestic manufacturing capabilities, with considerations for therapeutic areas and types of products to manufacture and assessment of gaps to bridge in local capacity. Read Part 3: Five Guiding Principles for Global Health Success here.

By focusing on domestic manufacturing as one potential pathway forward, we can strengthen supply chains, promote equitable access to global resources, and enhance overall pandemic preparedness and response. For more information on improving population health outcomes, contact us.

References

1 Government Notices accessed through Devex.com

2 Devex.com

3 https://africacdc.org/download/partnerships-for-african-vaccine-manufacturing-pavm-framework-for-action/

4 IQVIA, March 2022. Indonesia Market prognosis 2022 - 2026

5 Ibid.

6 https://www.bkpm.go.id/en/publication/detail/news/winning-potentials-in-indonesian-pharma-and-medical-industries

7 Global Business Report - CPhl, Industry explorations, Indonesia Pharmaceuticals, 2015

8 Pusdatin, Kementerian Perindustrian, 2021. Membangun Kemandirian Industry Farmasi nasional, Buku Analisis Pembangunan Industri, third edition

9 https://berkas.dpr.go.id/puskajianggaran/buletin-apbn/public-file/buletin-apbn-public-123.pdf

10 https://kebijakankesehatanindonesia.net/31-berita/berita-internasional/2725-analysis-new-investment-policy-will-likely-support-local-pharma-industry

11 Prof. Dr. Laksono Trisnantoro. Progressing Step to Achieve National Resilience in Pharma and Medical Devices. Wrap Up 2nd Technofarmalkes Workshop. G20 Summit 2022. Ministry of Health of the Republic of Indonesia (Aug 2022)

IQVIA Public Health & Government

Working across the health system to address key barriers to deliver high-quality, cost-effective care while improving health outcomes using our data-driven and population-centric solutions.