Meet the challenge of changing stakeholder demands and increasing cost constraints with IQVIA's integrated technology services and analytics-driven offerings.

- Blogs

- Getting the Most Out of Annual CMS Open Payments Data

Every year, U.S. Centers for Medicare & Medicaid Services (CMS) publishes new data from its Open Payments program, “a statutorily required, national disclosure program that promotes transparency and accountability.” Open Payments collects and publishes information about financial relationships between drug and medical device companies (a.k.a. “reporting entities”) and certain health care providers (“covered recipients”). These relationships may involve payments to providers for things such as research, meals, travel, gifts or speaking fees (among others).

Since the inception of the Open Payments program in FY 2014, CMS has published more than 78 million records totaling over $59 billion. In 2021, the program published 12.1 million records reflecting a value of $10.9 billion.

CMS Open Payments was developed to “provide the public with a more transparent health care system,” but it is also a unique and powerful tool for life sciences companies to analyze how their spending compares to peers in certain categories. As you might imagine, however, there is a big difference between having access to 78 million records and making sense of those records. For compliance stakeholders that struggle to obtain a structured analysis that makes the data accessible and usable, IQVIA offers brand- and channel-specific analyses about commercial engagements that deliver a comprehensive view of the competitive landscape.

PUTTING TRANSPARENCY DATA TO WORK FOR YOU

Transparency data from CMS can provide a variety of useful benchmark information that can drive greater insights around spend and utilization. For example, you can drill down on spend related to specific HCPs, brands, specialties, geographies, and more, across a number of payment categories. Careful analysis of this data can help identify a range of trends, such as how key opinion leaders (KOLs) and other experts are used in comparison with competitors.

There are two ways that one can access the Open Payments data: 1) through a web-based search of entity and covered recipient-level data, and 2) by downloading and analyzing the entire dataset for each year. The first option is a great way to quickly explore specific companies or recipients, but the second option is the more comprehensive approach that enables us to see the bigger picture and create more robust analyses.

For individual compliance stakeholders, the downside to this second, more robust approach is that it requires a lot of time and effort in order to create a structured, comprehensive dataset that is suitable for a deeper range of analyses. This is where IQVIA comes in.

After acquiring each year’s complete dataset, IQVIA is able to develop aggregated insights across this competitive landscape in order to answer questions such as “What are my competitors spending in aggregate in terms of a particular reporting entity? At a specific product level? On a particular type of engagement?” Along with additional data that IQVIA can provide around KOL mapping and influence mapping and other promotional or program benchmarking services, this data can be used to enable better decision-making and a clearer understanding of basic questions like “How does my company (or my product, or my commercial strategy) compare to the rest of the industry?”

EXAMPLE: OVERALL SPEAKER PAYMENTS

At IQVIA, we’re continually digging into the CMS data and eager to share the many ways it can provide useful, directional guidance around what’s happening in the industry and what that might mean for your operations. For example, let’s say you wanted to explore general trends related to spending on speaker fees (specifically, in terms only a bureaucrat could appreciate, “speaker payments using the compensation for services other than consulting, including serving as faculty or as a speaker at a venue other than continuing education programs”). Open Payments includes spending data according to categories such as meals (“food & beverage”), speaker payments, and consulting fees; and this data shows how much was paid, on what date, and the form of payment (in-kind or direct). The data identifies the speaker, the type of HCP (credentials or specialties), and their location, among other attributes.

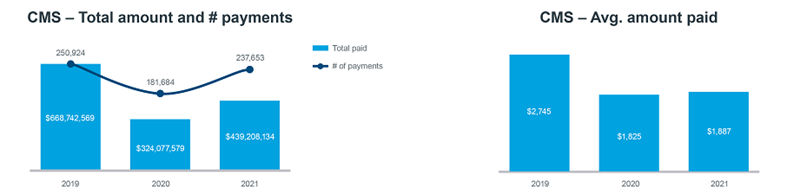

With all this data at hand, we can quickly capture (among many other things) recent trends in overall speaker payments and make some year-to-year comparisons. Most of us would probably expect that 2021 volume and spend would differ from 2020, given where we are in terms of the pandemic. As the charts below suggest, that certainly looks to be the case. Even more interestingly, while the overall number of payments made in 2021 are very close to (largely pre-pandemic) 2019, the average payment looks much closer to 2020 than it does to 2019.

One possible conclusion here is that the pandemic-driven shift towards delivering programs virtually has had an impact. Of course, there are a lot of factors that go into payments made to speakers: the duration of the program, the amount of preparation time, and travel time to name a few. But it is interesting that as volume ticked up, the average amount stayed roughly the same.

Another possible factor here could be that 2021 was the first year that CMS included mid-level practitioners in the reported data. Naturally, we would expect to see slightly lower fees for these mid-levels (though, of course, that’s very subjective and specific to each company). Nevertheless, the introduction of more virtual programs and the introduction of new prescriber types or covered recipient types are very likely the main drivers for what we’re seeing in the aggregated data.

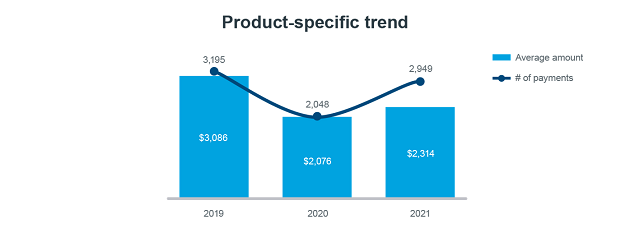

Similarly, we can examine these trends as they relate to a specific product, as shown in the chart below. In this case, we’re looking at spend related to a popular biologic that is now in the market, and the data show an uptick (roughly a 50% increase) in the number of payments made in 2021 compared to the previous year. Despite this uptick, however, the average amount of each payment made in 2021 is closer to 2020 than it is to 2019. This shows us that, as volumes continue to reach pre-pandemic levels, individual payments are not affected to the same extent. Again, these trends are likely due to changes in program type (i.e., virtual) and coverage recipient types.

For more details on these two examples, as well as additional analysis of some recent spending trends, please see the webinar 2021 Open Payments Data Analysis: A Deeper Understanding of Industry Trends. In this 30-minute program, Johan Holm, Principal of Commercial Compliance, shows how IQVIA makes the CMS data available and how it can be tailored to identify and better understand industry trends in payments and HCP utilization.

IQVIA provides a range of services around KOL identification, influence mapping, and promotional-programming benchmarking, all of which enhance any type of CMS-based analysis. We also offer a number of useful dashboards that help to dig into the CMS data for particular years as well as for multi-year benchmarking. These are especially useful as we’re moving beyond pandemic-influenced activities, and we expect that the 2022 data will be instrumental in showing whether spend, activity, and utilization are returning to pre-2020 levels or if there are significant differences in how the industry is spending its resources.

For our customers, this type of insight and analysis is valuable in helping to better understand how industry trends impact your commercial strategy, and answering questions such as “Does this impact decisions being made in our compliance program? Do policies have to change? Do we need to consider or reconsider our annual caps on speaker payments versus consulting? Do we need to look at enhancing our policies for virtual program?”

There are all kinds of valuable insights to be derived from looking more closely at this publicly available data. Contact us today to start the conversation about how we can help make CMS data work for your organization.

Related solutions

Partner with compliance experts to create, implement and manage efficient, end-to-end processes that ensure your organization is compliant with global engagement and transparency regulations and codes.

Keeping up with evolving disclosure requirements is a challenge. Discover how IQVIA Transparency Reporting can help you adeptly report, global HCP spend.