About the Report

A record number of new oncology drugs has been approved in recent years, bringing new treatment options to patients. However, despite robust levels of pipeline activity, oncology remains a challenging area for research and development. This report examines the productivity and output of the oncology pipeline, new treatment mechanisms, and which patients will likely benefit from new therapies. Our research brings into focus the amount spent on oncology medicines globally, clinical trial activity, complexity and success, and the outlook through 2023. The report also addresses shifts in therapy use with the emergence of immuno-therapies, Next-Generation Biotherapeutics and biosimilars.

Report Summary

A record 15 new oncology therapeutic drugs were launched in 2018 for 17 indications. Over half of the new therapies are delivered as an oral formulation, have an orphan indication or include a predictive biomarker on their label. Recently introduced therapies are also being used more broadly across varied tumor populations and in earlier lines of therapy. The use of immuno-oncology therapies has doubled in the United States since 2017 and treatment with novel CDK 4/6 inhibitors for HER-2 negative breast cancer has dramatically increased in the United States and Europe.

The pipeline of drugs in late-stage development expanded 19% in 2018 alone and 63% since 2013. Within the pipeline and across all phases of clinical development, the most intense activity is focused on nearly 450 immunotherapies with more than 60 different mechanisms of action. Ninety-eight Next-Generation Biotherapeutics – defined as cell, gene and nucleotide therapies - are also under clinical investigation and leverage 18 different approaches.

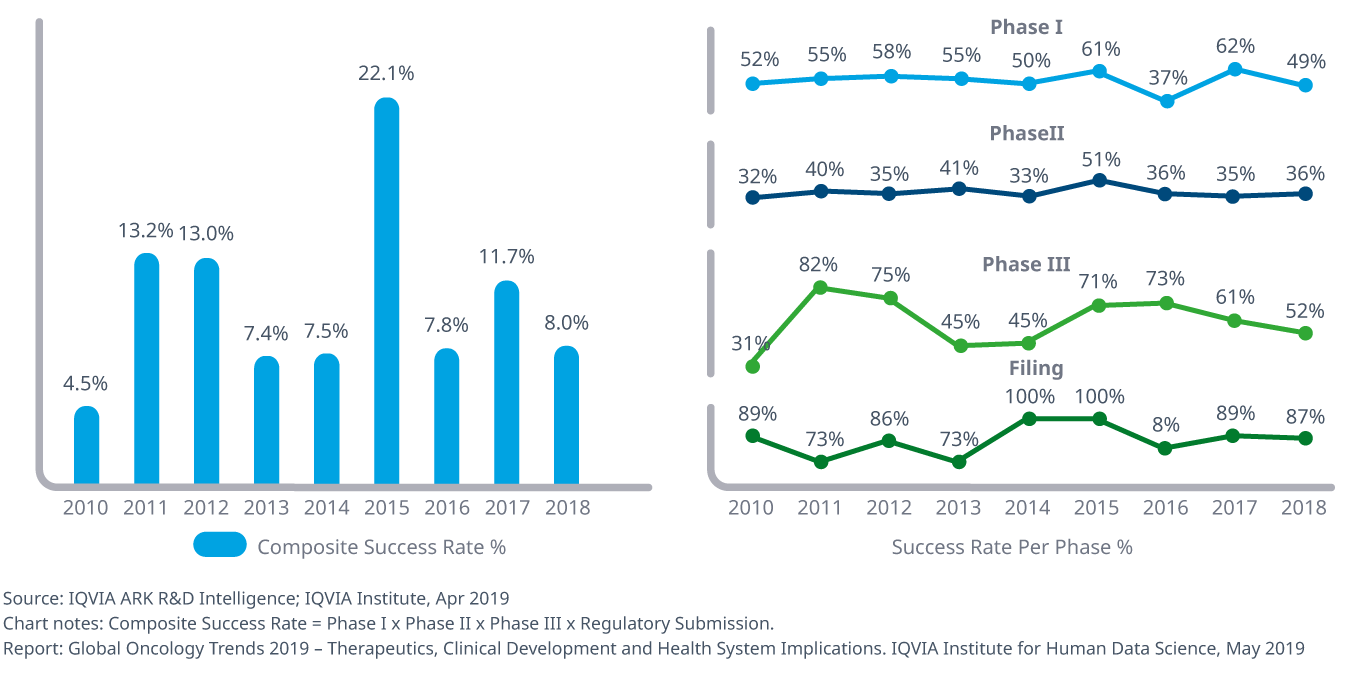

Despite high levels of pipeline activity, oncology remains one of the most challenging areas for research and development, facing significant risk of failure and long development times. The composite success rate for phase transitions fell to 8.0% in 2018 from 11.7% in 2017, and clinical trial duration remains higher for oncology trials than other disease areas. Clinical trial complexity has also increased sharply for phase I oncology trials over the past five years. The overall productivity of oncology trials – measured as success rates relative to trial effort (complexity and duration) – has improved by 22% since 2010 but remains far lower than trials for other therapy areas.

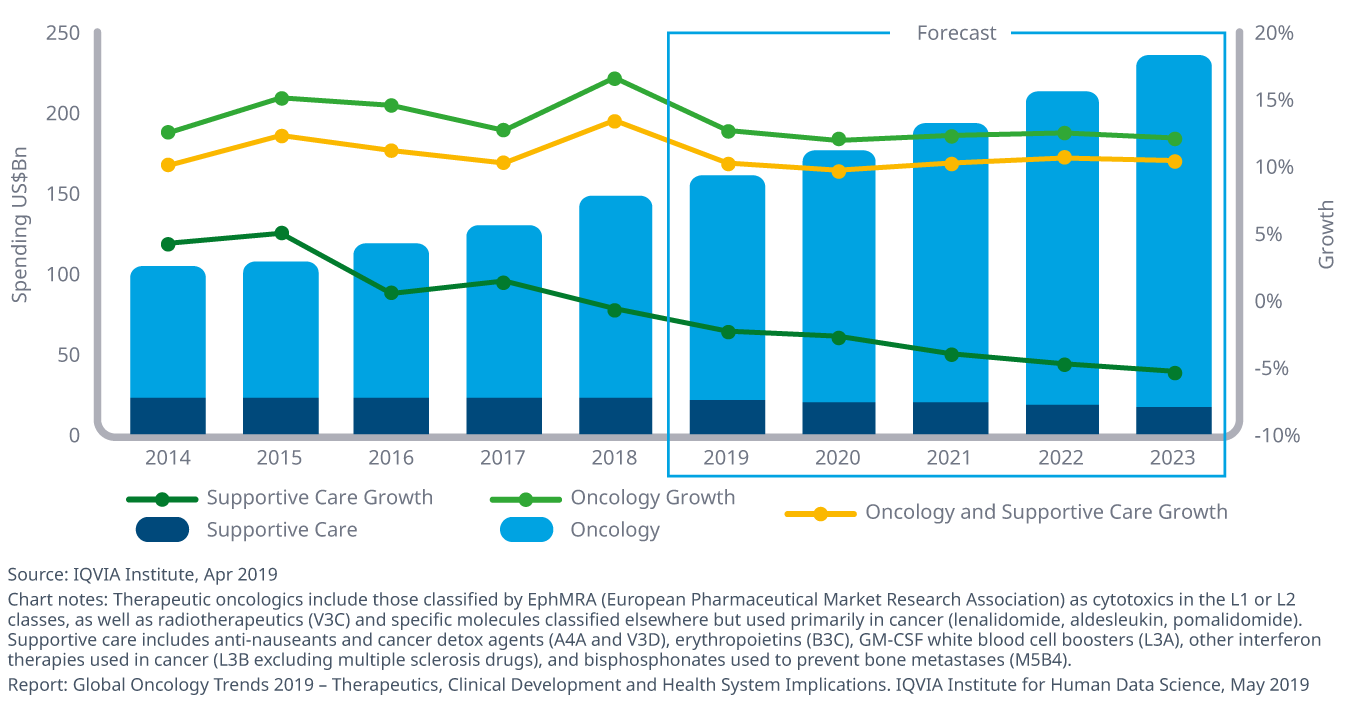

Spending on all medicines used in the treatment of patients with cancer reached nearly $150 billion in 2018 up 12.9% for the year and marking the fifth consecutive year of double-digit growth, driven entirely by therapeutic drugs which grew 15.9%. The average annual cost of new medicines continues to trend upward, although the median cost dropped by $13,000 in 2018 to $149,000, and cost per product ranged between $90,000 and over $300,000. China led pharmerging markets in spending and growth and grew a remarkable 24% in 2018 to $9 billion in total spending, even as supportive care treatments in China declined by 10%. Over the next five years, growth in therapeutics spending of 11–14% is expected on a CAGR basis, bringing the total market to $200–230 billion.

Key Findings

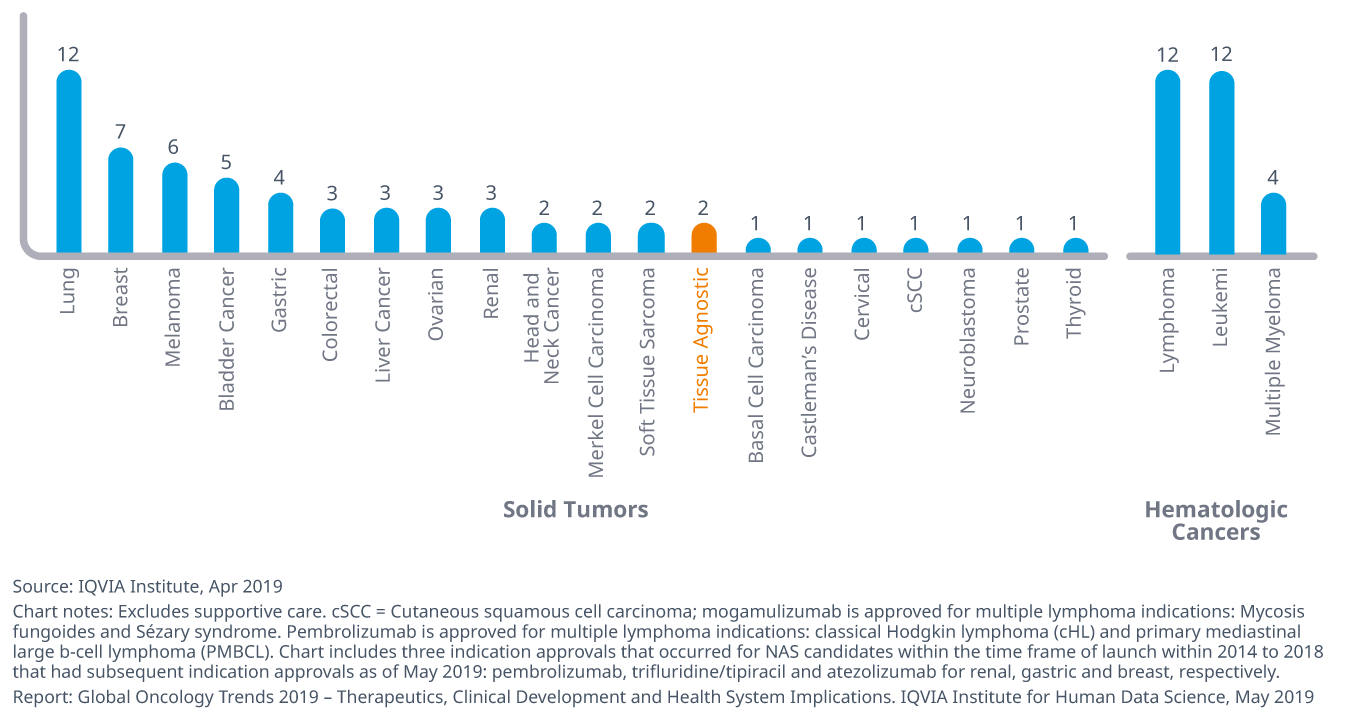

Over the past five years, 57 newly launched oncology therapeutics received approval for 89 indications, with some drugs treating multiple tumor types

- A record number of new oncology drugs was launched in 2018, bringing new treatment options to patients and continuing the transformation of treatment patterns occurring from the introduction of immunotherapies less than five years ago.

- Almost one-third of the approved indications over the past five years have been for hematologic cancers while lung cancer leads the solid tumors with 12 indications, followed by breast cancer and melanoma.

- In 2018, larotrectinib became the second tissue-agnostic oncology therapy to be approved, following the first approval of pembrolizumab in 2017. This reflects the beginning of a paradigm shift occurring in oncology to treat tumors based on genetic profile rather than site-of-origin in the body.

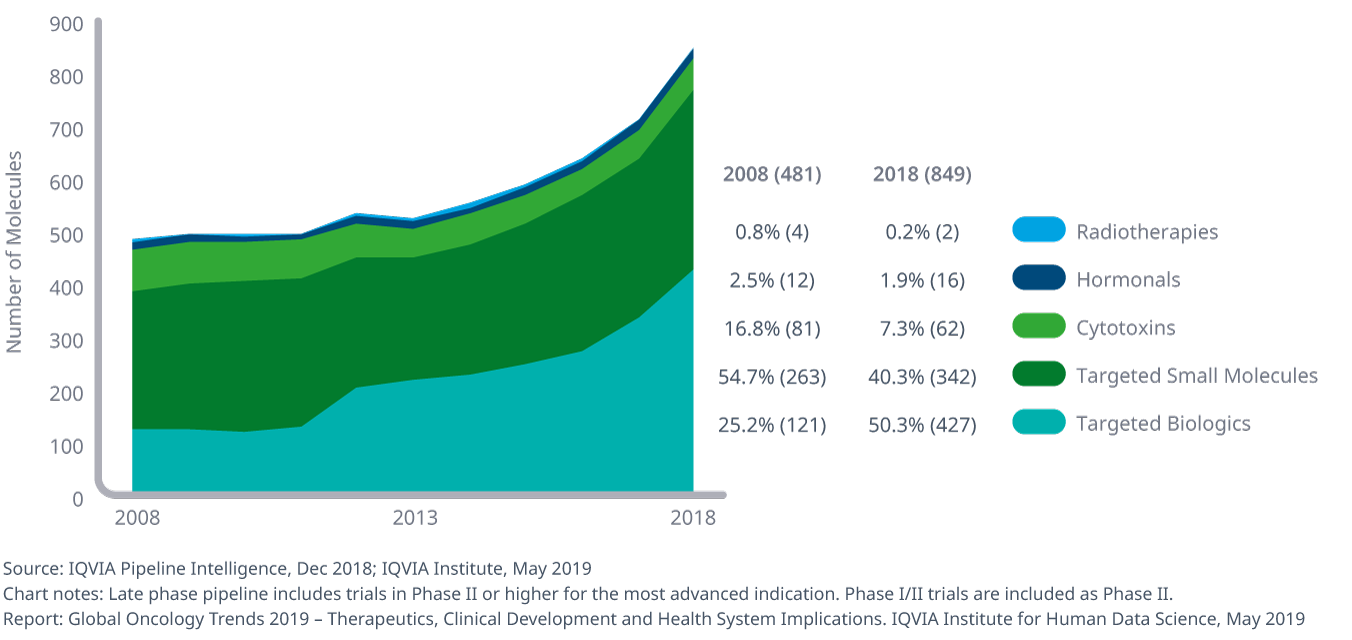

The late-stage oncology pipeline included 849 molecules in 2018, up 77% since 2008, due to the increasing number of targeted therapies

- The number of late-stage pipeline therapies grew from 711 in 2017 to 849 in 2018 – an expansion of 19% – due to the growing number of targeted therapies in the oncology pipeline.

- 91% of the late-stage oncology pipeline in 2018 were targeted small molecule and biologic therapies, rather than non-specific therapies like cytotoxic agents.

- The increasing numbers of medicines in the pipeline is particularly notable because of the range of mechanisms being explored, the numbers of companies involved and the rate at which the research is progressing.

- In late-stage oncology R&D, 711 companies are active, working on a total of 849 products, with the majority (88%) from emerging biopharma companies.

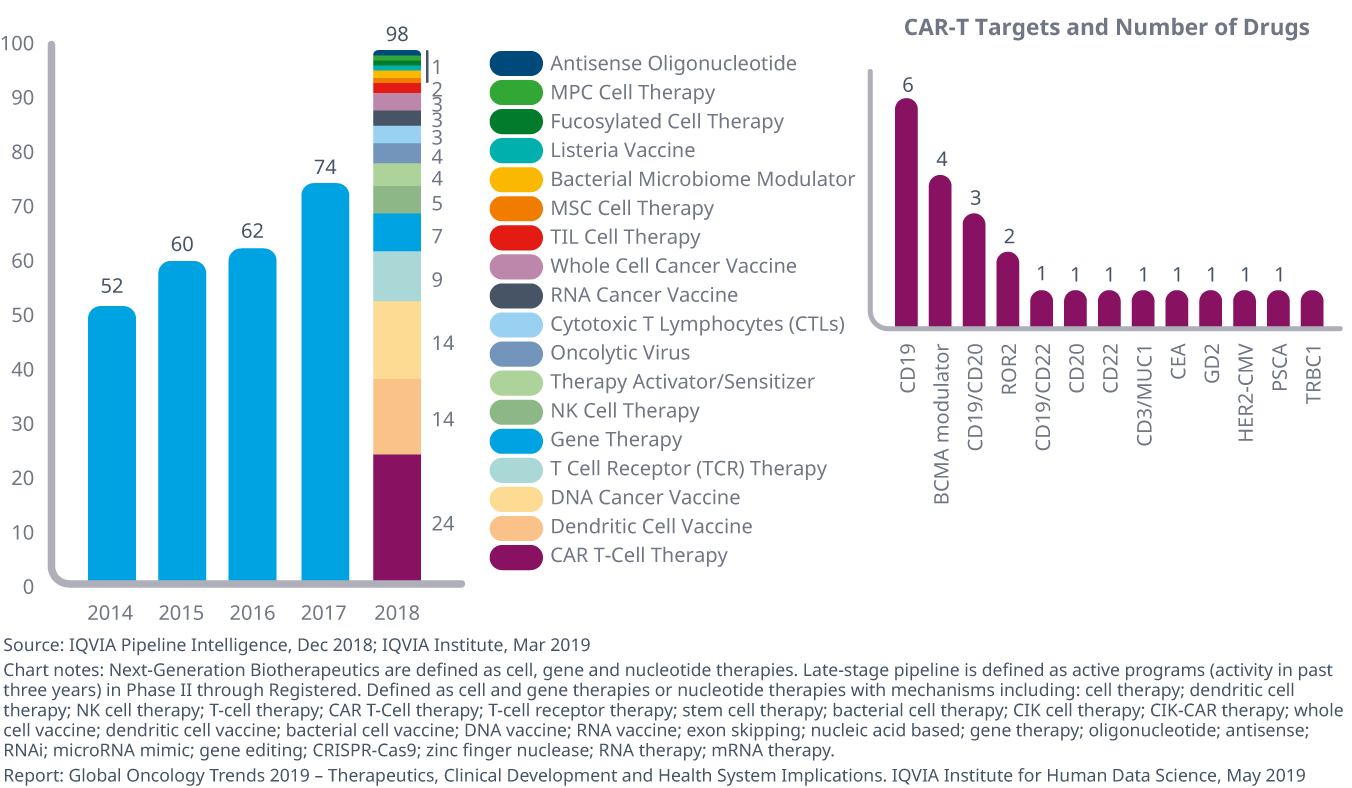

Almost 100 Next-Generation Biotherapeutics are now in late-stage development

- The number of Next-Generation Biotherapeutics − defined as cell, gene and nucleotide therapies − in development for oncology has more than doubled since 2013 and has grown 32% from 2017 to 2018, as new pathways for disease treatment and cure command growing attention and investment.

- Nearly 450 immuno-oncology therapies are currently in development across all phases, with the Phase III and pre-registration pipeline containing nine mechanisms and the early- stage pipeline containing 62 mechanisms.

- PD1/PD-L1 checkpoint inhibitors remain the most successful immuno-oncology therapies, and improvements in formulation (e.g., oral) or immunotherapy combinations with targeted therapies (e.g., TKIs) or Next-Generation Biotherapeutics may lead to therapy breakthroughs.

Oncology clinical trials have a high risk of failure with a composite success rate of 8% in 2018, slightly lower than the average since 2010

- The composite success rate, which measures the likelihood a product entering Phase I will reach the market, has remained roughly the same since 2013 for oncology products, and varies between 7–8%, with 2015 and 2017 remaining higher than average. The overall average from 2010–2018 was 10.6%.

- Across all trial phases, the average duration of an oncology trial in 2018 was 3.2 years compared to 1.8 years across all other therapy areas, a difference of over 40%.

- Clinical trial complexity in oncology has risen 11% from 2014 to 2018 and 22% from 2010 to 2018 and is being driven by increases in the number of endpoints and eligibility criteria and offset by declines in the number of countries and number of sites included.

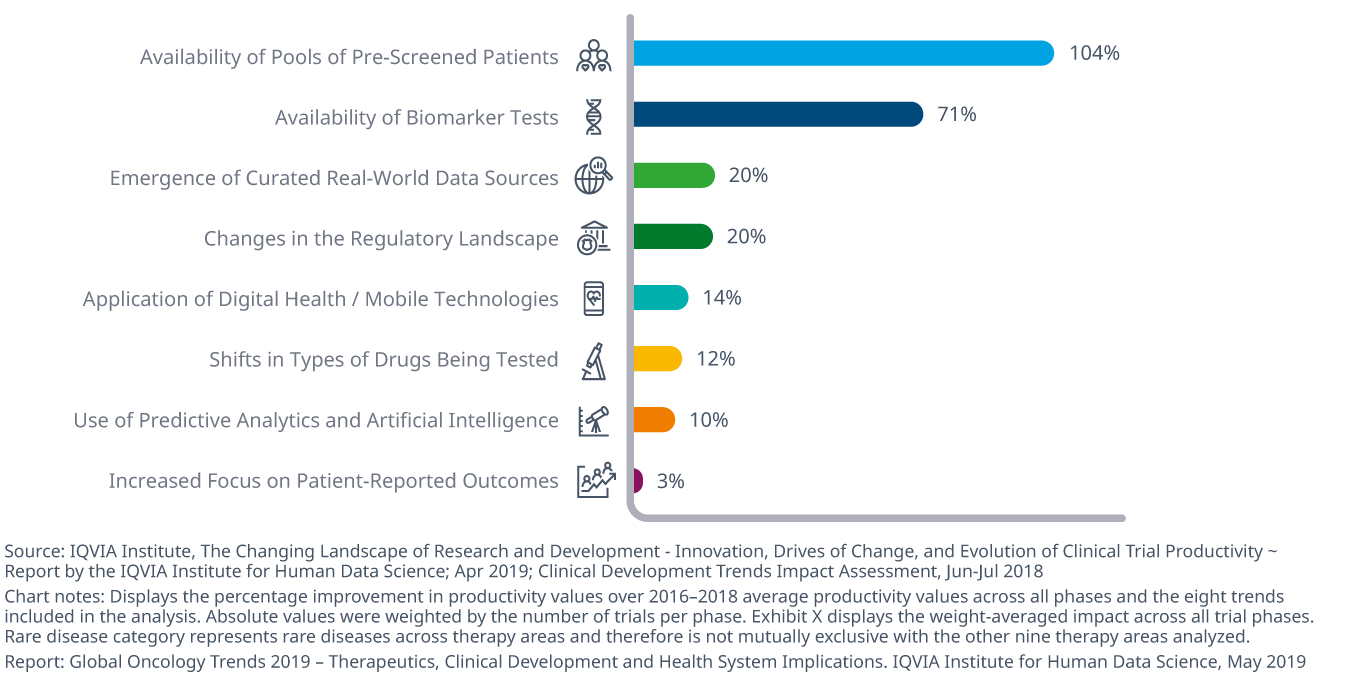

Modelling the impact of current clinical development trends on future productivity, the availability of pools of pre-screened patients and biomarker tests could yield productivity improvements of as much as 104% and 71%, respectively, by 2023.

- Overall productivity of oncology trials – measured as success rates relative to trial complexity and duration – has improved by 22% since 2010 but remains far lower than trials for other therapy areas.

- The most impactful trend in oncology development is expected to be the availability of pre-screened patients, to assess eligibility for trials and enhance the speed and efficiency of trials.

- Biomarkers continue to be discovered, both as a result of drug discovery and through other research, and the wider range and availability of tests will significantly enhance all aspects of drug development.

Oncology spending will reach nearly $240 billion through 2023, growing 9–12%

- Spending on all medicines used in the treatment of patients with cancer reached nearly $150 billion in 2018 up 12.9% for the year, driven by therapeutic drugs, as spending on supportive care drugs declined 1.5% in 2018.

- The average annual cost of new oncology medicines continues to trend up, although the median cost dropped $13,000 in 2018 to $149,000.

- Oncology spending in China has more than doubled in the past five years, mostly coming from increased use of existing branded medicines, and very little from newly launched medicines and per capita spending in China amounts to $4.50 per person, compared to $173 in the United States.

- Growth in spending on oncology therapeutics through 2023 is forecast at double-digit levels in the United States, pharmerging markets and rest-of-world, will reach the high single-digit growth in the EU5, and 5–8% in Japan.