Bring your biosimilar to market faster by tapping into unparalleled data, technology, advanced analytics, and scientific expertise.

- Blogs

- Optimizing Global Oncology Biosimilars Trials

With continuing patent expiries among biologics used in oncology, biosimilar development is a highly active area (Figure 1). Between 2007 and 2020, 33 biosimilars for oncology were approved by the European Medicines Agency (EMA), 16 by the U.S. Food and Drug Administration (FDA), and 10 by the Japan Pharmaceuticals and Medical Devices Agency (PMDA).1 The FDA has approved at least 22 cancer or cancer-related biosimilars since 2015.2

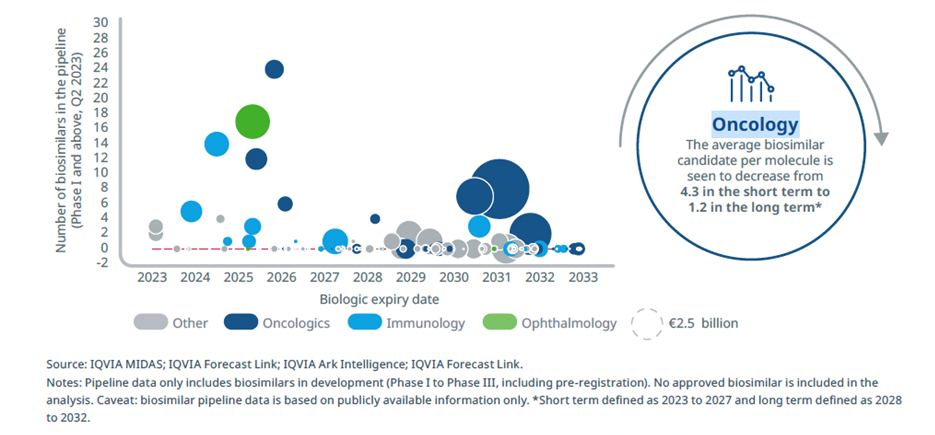

Over the next 10 years, an estimated 24% of biologic losses of exclusivity will be among oncology therapies, according to an IQVIA Institute report on biosimilars in Europe.3 Globally the oncology biosimilars market is estimated at $4.19 billion in 2022, an increase of 28% on 2021, with rapid growth forecast to continue.4

Figure 1: Oncology biosimilars in the R&D pipeline5

In this competitive environment, biosimilar sponsors planning global clinical trials should consider working with a highly experienced partner to develop their therapies more quickly and cost effectively. Sponsors can benefit especially from leveraging an existing network of partner sites that are pre-qualified and experienced. This site network will already have worked in close alignment with the partner during previous trials, which benefits new trials by enhancing patient recruitment, accelerating site activation times and improving data delivery.

IQVIA has a proven track record in oncology biosimilar trials, with the ability to provide sponsors with a thorough understanding of the biologics landscape, drive patient enrollment, navigate regulations, and conduct flexible trials. Over the past few years, IQVIA has been focused on leveraging this experience, supported by data analyses and local site knowledge, to build out our IQVIA Biosimilar Site Network (BS). This is a flexible and experienced network of sites expanding across Europe, Africa, Asia and Latin America. It is composed of healthcare professionals who are interested in, and have the appropriate facilities to, conduct biosimilar research, including the necessary pharmacokinetic (PK) studies often required.

IQVIA’s Biosimilar Site Network is part of our wider site network strategy in which we have been actively developing and expanding our strategic relationships with a wide range of Investigators and sites globally for more than 15 years. We call these our Prime & Partner sites, with the overarching strategy being to develop collaborative, long term relationships between IQVIA and our partner sites with the shared goal of accelerating clinical research and providing better patient outcomes. To support this goal, IQVIA has dedicated site-specific managers to enhance communication and collaboration at the site level. This model creates a closely aligned, highly predictable trial ecosystem with strong operational efficiencies, ensuring that all network sites use the same or similar processes, which can decrease trial timelines by up to 50%.

Network sites that lead in trial recruitment include our Partners and top-ranked Prime Sites. These sites routinely use technology and research to drive excellence in trials. IQVIA Partner and Prime sites comprise about 70% of our company’s site network in Europe and 50% in India and China.

To sustain strong engagement, Prime Sites have dedicated, on-site IQVIA managers who are the single point of contact, driving operational efficiencies. We also jointly create trial infrastructures and capacities. As a result, our network sites have higher average recruitment rates than out-of-network sites. For example, Partner and Prime sites delivered 58% of all of the oncology patients recruited by IQVIA for our clients’ biosimilar trials in 2017 to 2022. This efficiency supports sponsors’ success in competing for sites and patients.

Within the IQVIA network, we have created a group of sites with very high recruitment performance and oncology expertise. For example, in China from 2017 to 2022 , IQVIA helped recruit more than 9,000 patients into oncology biosimilar trials. Our oncology-specific biosimilar network outperformed regular biosimilar sites in China by recruiting about 54% of patients across Phase 1, 2 and 3 trials. Similarly, in Europe, where the top 10 recruiting countries delivered 79% of oncology trial participants, the majority came via the IQVIA Biosimilar Site Network, which contributed a median of 63% of patients per country.

Strong CRO site networks also benefit sponsors in terms of start-up timelines. For example, in oncology biosimilar studies in 2011 to 2022, IQVIA Prime and Partner sites were 8% faster to activate – 16% faster for breast cancer trials – and 19% faster to achieve first patient first visit status compared to non-partner sites.

For sponsors wishing to optimize the velocity, integrity, and value of their oncology biosimilars studies, IQVIA can provide insights into market and regulatory trends, patent expiry timetables, and new compounds in development. A partnership with IQVIA can inform sponsor decisions on development planning and optimize returns from biosimilar investments.

References

1 Bennett CL, Schoen MW, Hoque S, Witherspoon BJ, Aboulafia DM, Hwang CS, Ray P, Yarnold PR, Chen BK, Schooley B, Taylor MA, Wyatt MD, Hrushesky WJ, Yang YT. Improving oncology biosimilar launches in the EU, the USA, and Japan: an updated Policy Review from the Southern Network on Adverse Reactions. Lancet Oncol. 2020 Dec;21(12):e575-e588. doi: 10.1016/S1470-2045(20)30485-X. Erratum in: Lancet Oncol. 2021 Feb;22(2):e42. PMID: 33271114.

2 Rodriguez G, Mancuso J, Lyman GH, Cardoso F, Nahleh Z, Vose JM, Gralow JR, Francisco M, Sherwood S. ASCO Policy Statement on Biosimilar and Interchangeable Products in Oncology. JCO Oncol Pract. 2023 Jul;19(7):411-419. doi: 10.1200/OP.22.00783. Epub 2023 Apr 7. PMID: 37027797.

3 Aitken M, Arias A, Newton M, Travaglio M, Troein P. Assessing the biosimilar void: Achieving sustainable levels of biosimilar competition in Europe. IQVIA Institute, October 2023.

4 Research and Markets. Press release, Unlocking the Potential: Investment in R&D Drives Oncology Biosimilars Growth 2023. 2023Sep21 [cited 2024Mar11]. Available from: https://finance.yahoo.com/news/unlocking-potential-investment-r-d-114800792.html

5 Aitken M, Arias A, Newton M, Travaglio M, Troein P. Assessing the biosimilar void: Achieving sustainable levels of biosimilar competition in Europe. IQVIA Institute, October 2023.

Related solutions

Focus oncology development on the patient, manage trial complexity, and increase predictability and speed.