- Locations

- Middle East & Africa

- Unlocking the Promising Opportunities of Biosimilars in the Middle East and Africa Market

Biosimilars are a safe, effective, and cost-saving viable alternative to biologics in overcoming the barrier of patient access and reducing the economic burden on the healthcare system [1]. Biosimilars have also favored a shift toward targeted or personalized treatments and improved the prognosis of patients with various clinical conditions [2,3]. Biosimilars access in global or regional markets is governed by several factors namely-epidemiology of the patients, including regulatory framework, pricing dynamics, reimbursement policies and competitive landscape of the region [4]. This blog thereby focuses on the current and future trends of the biosimilars market in the Middle East and Africa (MEA) region.

The MEA region is considered as an influential emerging pharmaceutical market in terms of regulatory improvements, shift toward value-based healthcare, implementation of universal health coverage, and promotion of biosimilars [5]. In line with the global market trends, during the past few years, biosimilars have gained traction in MEA [2]. The increasing aging population, reimbursement and healthcare challenges, and increased prevalence of chronic and non-communicable diseases in the MEA region make the advent of biosimilars even more promising and create a potential business opportunity [6]. Evidence reports the biosimilar market of Middle East and North Africa (MENA) region was valued at USD 442.5 million in 2020 which is further projected to surpass USD 623.7 million by 2027 (an increase at a Compound Annual Growth Rate of 3.9%) [7].

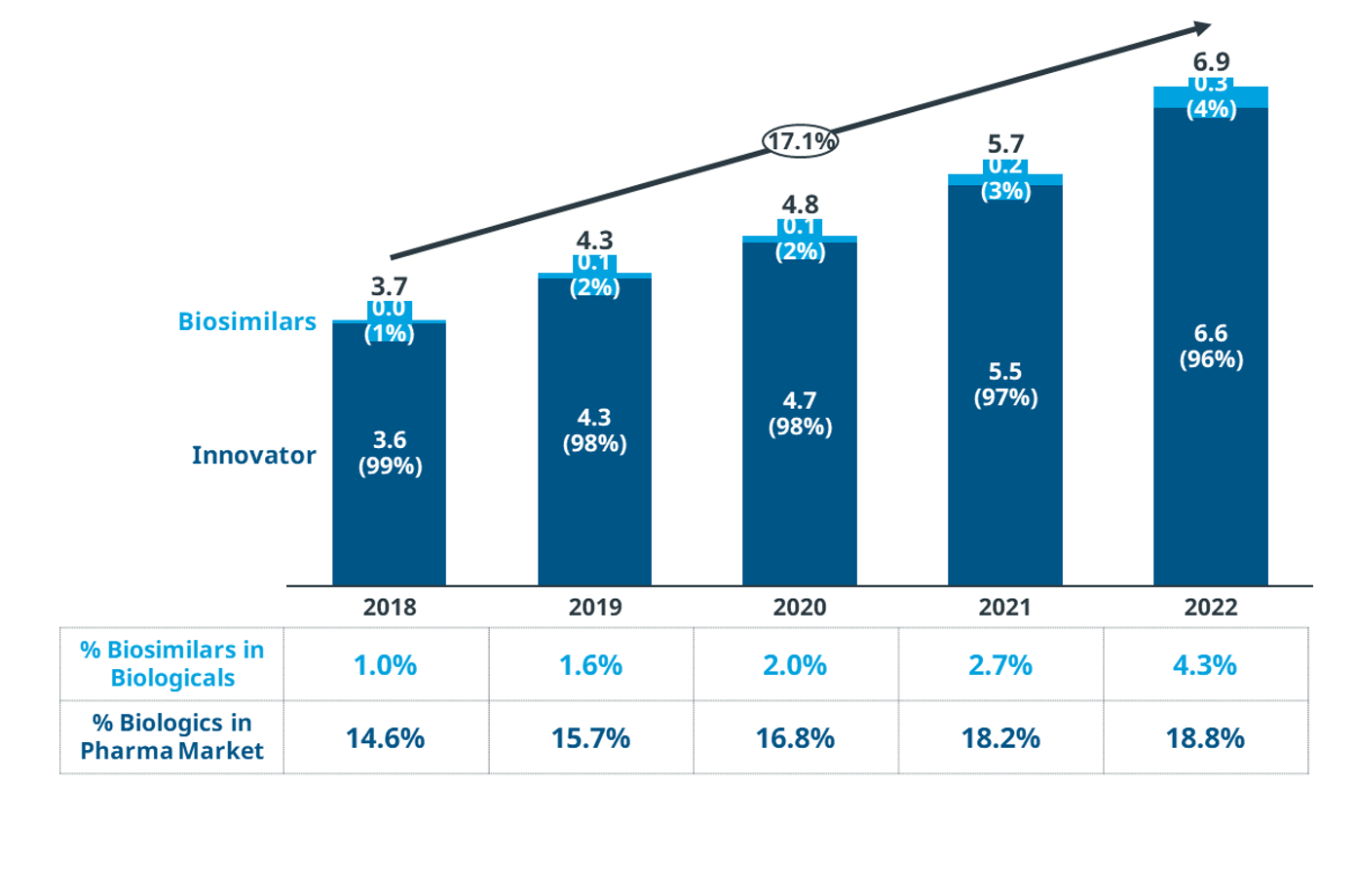

As per IQVIA analysis, the biologic market share in the MEA region has increased from 14.6% in 2018 ¬to 18.8% in 2022 and is valued at USD 6.9 billion with originator products dominating the market space. However, the uptake of biosimilars has seen an upward trend in the recent past with the market share increasing from 1.0% in 2018 to 4.3% in 2022. Our analysis included the following countries: Tunisia, Morocco, Algeria, West Africa, South Africa, Egypt, Turkey, Lebanon, United Arab Emirates (UAE), Kuwait, Kingdom of Saudi Arabia (KSA), and Jordan (Figure 1).

|

|

Figure 1: Market share of biologics and biosimilars

Source: IQVIA Internal Database, MEA Databook MATQ3

The key factors governing the biosimilar market in the MEA region are regulatory approval pathway, increased competitor intensity, reduced pricing for biosimilars, and significant loss of exclusivity. The regulatory agencies in the region perform exhaustive clinical and analytical assessment of the biosimilar to ascertain whether they qualify for marketing approval [3]. Unlike European Union and United States of America that have robust biosimilar approval guidelines, the regulatory framework in the MEA region is either in the nascency or evolution stage.

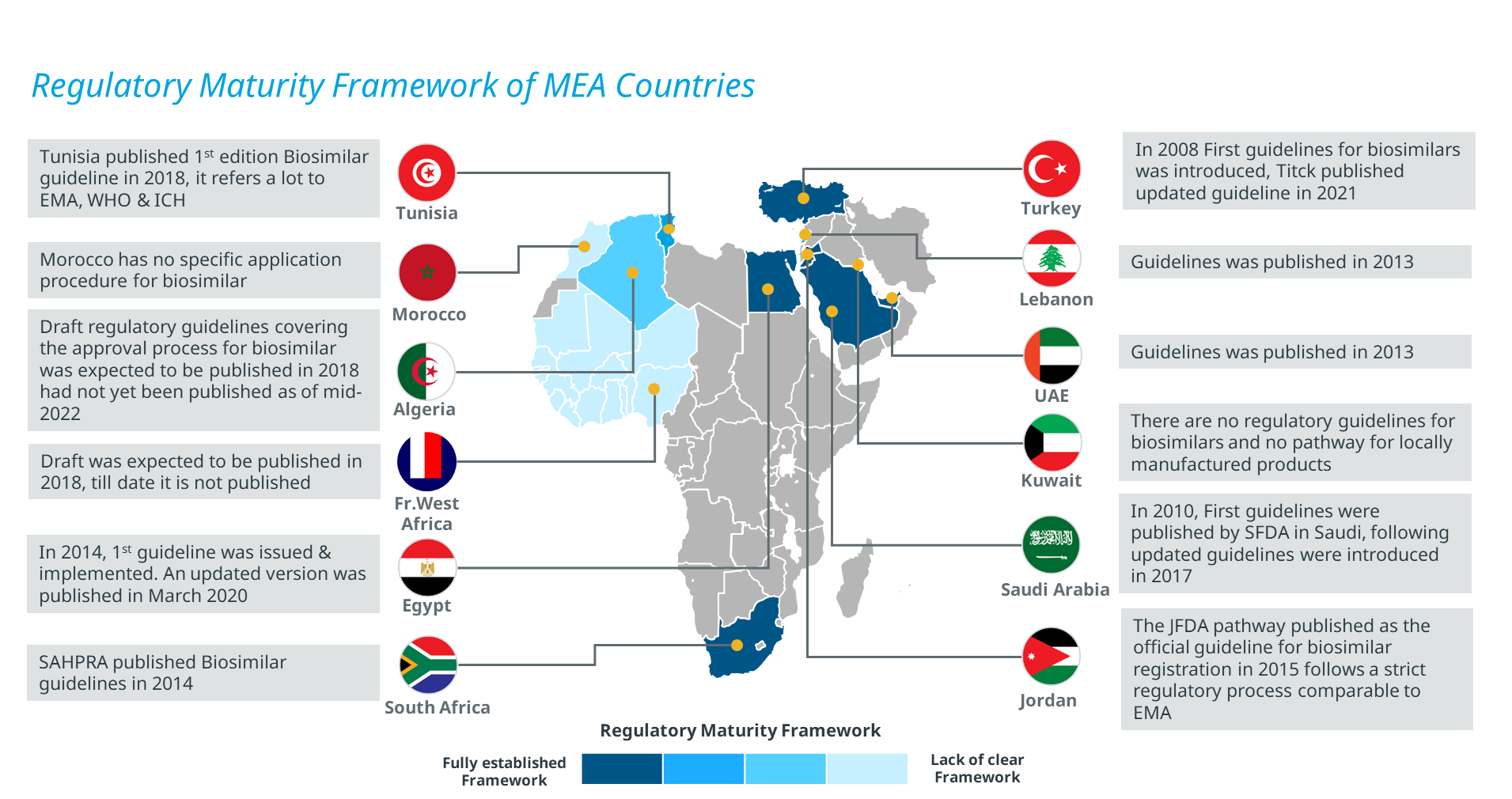

Majority of the countries in the Middle East, including KSA and UAE, have developed regulatory guidelines for the approval of biosimilars, while others have overhauled the regulatory procedure to boost their accessibility. On the contrary, the regulatory framework for the African countries is still in the nascent stage except in South Africa, Egypt, and Tunisia. Currently, Kuwait and Morocco do not have any specific regulatory guidelines for the approval of biosimilars (Figure 2). However, it is prudent to expedite the biosimilar approval pathway to avoid the introduction of intended copies of the biologics into MEA regions along with compromising the patient safety and clinical outcomes of such agents [8].

Figure 2: Regulatory framework of various countries in the MEA region

Abbreviations: EMA: European Medicines Agency; ICH: International Council for Harmonization; JFDA: Jordan Food and Drug Administration; SAHPRA: South African Health Products Regulatory Authority; SFDA: Saudi Food and Drug Administration; WHO: World Health Organization

Source: Secondary Research

The development of biosimilars also allows competition in the marketplace, leading to reduced prices and paving way for healthcare sustainability [2]. The biosimilar market is highly competitive and dynamic, wherein many players venture into the market creating substantial demand. According to our analysis, there are many entrants in the biosimilar market in MEA with significant contribution from the local players. Commercial collaboration by virtue of granting market access was one of the prominent strategies for the success of biosimilar in the region. The entry of 2-4 competitors for a molecule has boosted the volume share of biosimilars by 30-80% leading to price reduction when compared to the originator product. The market dynamics of UAE (for trastuzumab) has revealed the maximum number of competitor entrants within the biosimilar trajectory.

Majority of the markets in MEA have cost-conscious healthcare systems, and choices about reimbursement are influenced by factors like drug costs and clinical results. Furthermore, most of the MEA marketplaces have planned phased price reductions for pharmaceuticals. Additionally, the economic unrest caused by the price of oil has increased the strain on healthcare systems, including those in the UAE, Algeria, and the KSA, to keep the drug cost in check [2,3]. The biosimilar competition also significantly imposes a restriction on the overall drug spend and contributes toward healthcare savings [9]. In addition to reducing the public healthcare expenditure on biological therapies, biosimilars also increases the accessibility of these medications to broader population and allows budgetary re-distribution [2,8]. The IQVIA analysis using an IQVIA database confirmed on the pricing discount of up to 80% on biosimilars when compared to originator products. The maximum pricing discount was observed in UAE for trastuzumab and KSA for adalimumab with the entry of multiple competitors.

According to our analysis, many key biologics are currently on the verge of losing their market exclusivity by 2027 in the MEA region, leading to a considerable decline in their market share. The pharmaceutical companies are cautious about their products going off-patent. It is believed that the loss of exclusivity (LoE) of biologics marked the turning point for biosimilars, prompting their exponential growth.

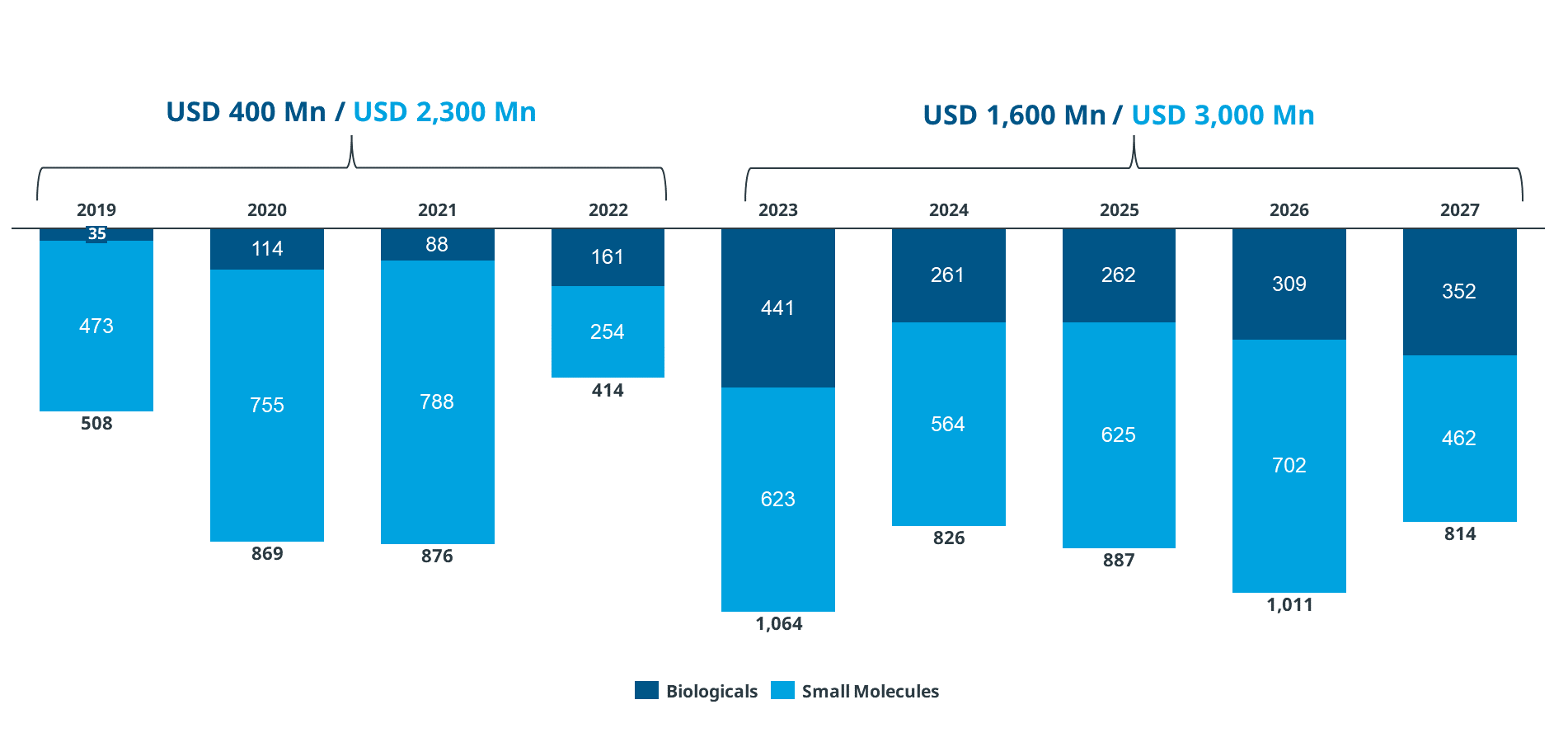

IQVIA analyzed the historical trend of biologics and biosimilar uptake and associated cost along with future projections till 2027 and highlighted the trends followed throughout the MEA region at a country level.

- The projections reiterated that many biologics will be losing their exclusivity in the next five years, the total amount of which sums up to nearly USD 1.6 billion (Figure 3)

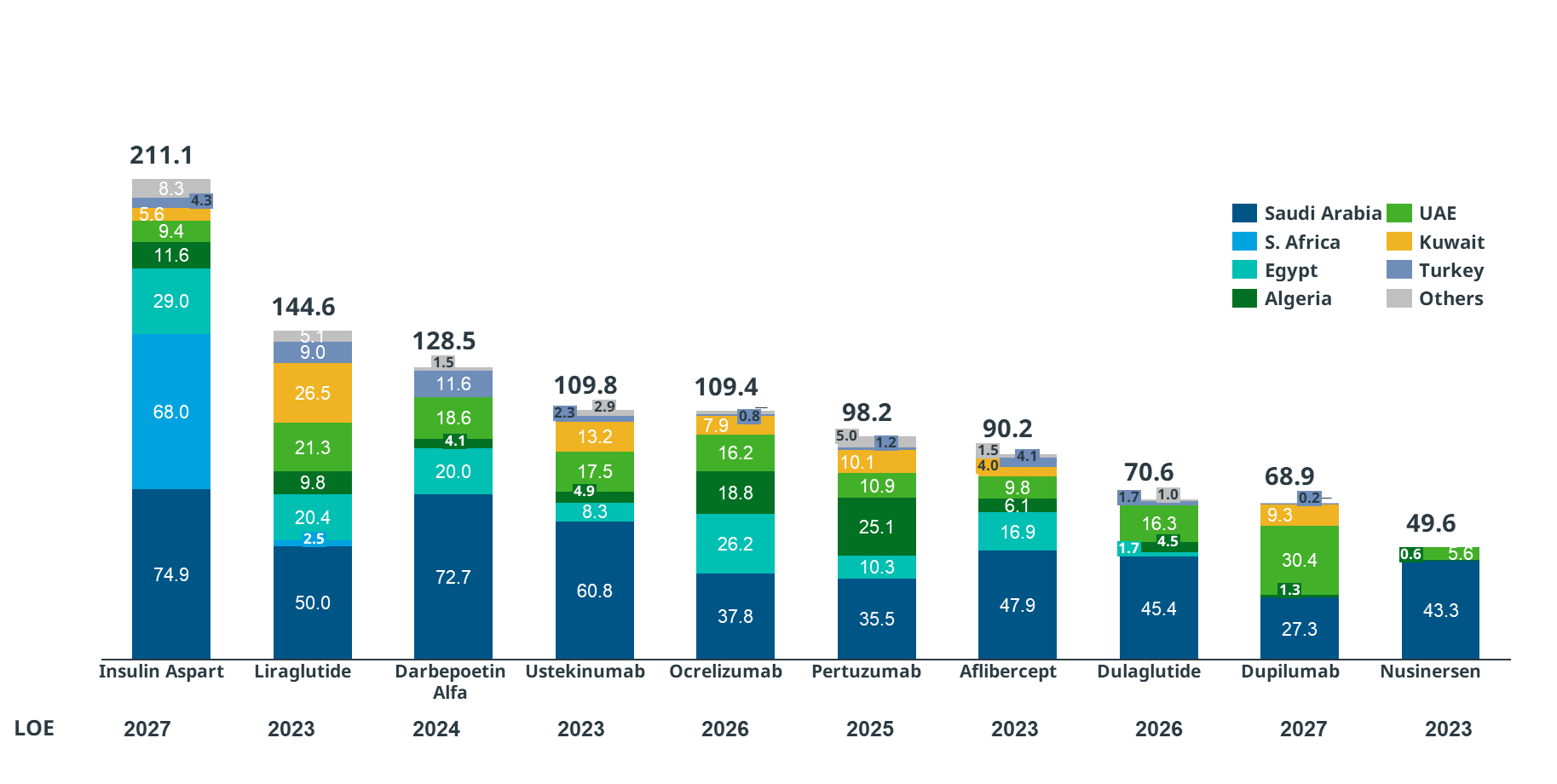

- Majority of the drugs to go off-patent belongs to the therapeutic category of anti-diabetic agents with liraglutide, dulaglutide, and insulin aspart losing the rights in 2023, 2026, and 2027 respectively. The market share of these three agents cumulates to USD 426.3 million (highest in the region; considering the Q3 2022 sales of the molecule going off-patent) (Figure 4)

- KSA is leading in the MEA region for the maximum market share of biosimilars. Insulin aspart (USD 74.9 million), darbepoetin alfa (USD 72.7 million), and ustekinumab (USD 60.8 million) (Figure 4)

Figure 3: The market forecast for biologics in the MEA region

Abbreviations: USD: United States Dollar; Bn: Billion Source: IQVIA Internal Database, MEA Databook MATQ3

Note: The LoE for the study was defined based on loss of protection in US; Adalimumab was considered as off-patent in MEA considering the biosimilars marketed for this molecule. Additionally, the molecules were considered from the time when their sales were registered (not from their marketing approval date).

Figure 4: Loss of exclusivity data for different molecules across various countries

Abbreviations: LoE: Loss of Exclusivity; MEA: Middle East and Africa; Mn: Million; USD: United States Dollar Source: IQVIA Internal Database, MEA Databook MATQ3 Note: The LoE for the study was defined based on loss of protection in US; Adalimumab was considered as off-patent in MEA considering the biosimilars marketed for this molecule. Additionally, the molecules were considered from the time when their sales were registered (not from their marketing approval date).

Therefore, it is reasonable to assume that biosimilars are essential for increasing biologics' affordability, reducing costs for both patients and payers, and customizing biologic prices. Additionally, the possibilities for biosimilars are expanding due to LoE of numerous well-known biologics. However, improving the prospects for biosimilars in the MEA region will require proper channelization. A review of the reimbursement system and strict rules will help biosimilars succeed in the area.

Utilizing a thorough grasp of market dynamics, right from clinical to commercial, is essential for new biopharma and biotech companies to succeed in today's competitive environment. By conducting commercial and technical due diligence, evaluating performance improvement prospects, and offering a portfolio valuation, our advisory team can help you maximize your healthcare investments value, with evidence. Gain the clarity you need to confidently invest in a dynamic healthcare environment by utilizing our all-encompassing solutions that strategically combine top-tier experience, technology, and data. To learn more, click here: https://www.iqvia.com/solutions/industry-segments/financial-institutions

Acknowledgment - The authors would like to thank Yukti Singh and Bushra Nabi for their medical writing support.

References

- Kvien, T.K.; Patel, K.; Strand, V. The cost savings of biosimilars can help increase patient access and lift the financial burden of health care systems. Seminars in Arthritis and Rheumatism 2022, 52, 151939, doi:https://doi.org/10.1016/j.semarthrit.2021.11.009.

- Batran, R.A.; Elmoshneb, M.; Hussein, A.S.; Hussien, O.M.; Adel, F.; Elgarhy, R.; Morsi, M.I. Biosimilars: Science, Implications, and Potential Outlooks in the Middle East and Africa. Biologics 2022, 16, 161-171, doi:10.2147/btt.S376959.

- Realizing Biosimilar Potential in the Middle East and Africa. Available online: https://www.iqvia.com/locations/middle-east-and-africa/library/white-papers/realizing-biosimilar-potential-in-the-middle-east-and-africa (accessed on 4 April).

- Simoens, S.; Vulto, A.G. A health economic guide to market access of biosimilars. Expert Opinion on Biological Therapy 2021, 21, 9-17, doi:10.1080/14712598.2021.1849132.

- Ansari, S. Key Developments and Trends in the Middle East and African Pharmaceutical Markets. Available online: https://www.iqvia.com/library/articles/key-developments-and-trends-in-the-middle-east-and-african-pharmaceutical-markets (accessed on 5 April).

- Hamzi, T. Evaluation of biosimilars landscape in the MENA region: what lessons can be learnt from the European experience to improve the biosimilars uptake in the region? 2019.

- MENA Biologics & Biosimilars Market to Surpass US$ 623.7 by 2027, Says Coherent Market Insights (CMI). Available online: https://www.businesswire.com/news/home/20210202005632/en/MENA-Biologics-Biosimilars-Market-to-Surpass-US-623.7-by-2027-Says-Coherent-Market-Insights-CMI (accessed on 6 April).

- Almaaytah, A.; Mashaqbeh, H.; Haddad, R. Current Status of Biosimilar Regulations in the MENA Region. International Journal of Research in Pharmaceutical Sciences 2020, 11, 3443-3449, doi:10.26452/ijrps.v11i3.2484.

- The Impact of Biosimilar Competition in Europe. Available online: https://www.iqvia.com/-/media/iqvia/pdfs/library/white-papers/the-impact-of-biosimilar-competition-in-europe-2022.pdf (accessed on 4 April).