-

Americas

-

Asia & Oceania

-

A-I

J-Z

EMEA Thought Leadership

Developing IQVIA’s positions on key trends in the pharma and life sciences industries, with a focus on EMEA.

Learn more -

Middle East & Africa

EMEA Thought Leadership

Developing IQVIA’s positions on key trends in the pharma and life sciences industries, with a focus on EMEA.

Learn more

Regions

-

Americas

-

Asia & Oceania

-

Europe

-

Middle East & Africa

-

Americas

-

Asia & Oceania

-

Europe

Europe

- Adriatic

- Belgium

- Bulgaria

- Czech Republic

- Deutschland

- España

- France

- Greece

- Hungary

- Ireland

- Israel

- Italia

EMEA Thought Leadership

Developing IQVIA’s positions on key trends in the pharma and life sciences industries, with a focus on EMEA.

Learn more -

Middle East & Africa

EMEA Thought Leadership

Developing IQVIA’s positions on key trends in the pharma and life sciences industries, with a focus on EMEA.

Learn more

SOLUTIONS

-

Research & Development

-

Real World Evidence

-

Commercialization

-

Safety & Regulatory Compliance

-

Technologies

LIFE SCIENCE SEGMENTS

HEALTHCARE SEGMENTS

- Information Partner Services

- Financial Institutions

- Public Health and Government

- Patient Associations

- Payers

- Providers

THERAPEUTIC AREAS

- Cardiovascular

- Cell and Gene Therapy

- Central Nervous System

- GI & Hepatology

- Infectious Diseases and Vaccines

- Oncology

- Pediatrics

- Rare Diseases

- View All

Impacting People's Lives

"We strive to help improve outcomes and create a healthier, more sustainable world for people everywhere.

LEARN MORE

Harness the power to transform clinical development

Reimagine clinical development by intelligently connecting data, technology, and analytics to optimize your trials. The result? Faster decision making and reduced risk so you can deliver life-changing therapies faster.

Research & Development OverviewResearch & Development Quick Links

Real World Evidence. Real Confidence. Real Results.

Generate and disseminate evidence that answers crucial clinical, regulatory and commercial questions, enabling you to drive smarter decisions and meet your stakeholder needs with confidence.

REAL WORLD EVIDENCE OVERVIEWReal World Evidence Quick Links

See markets more clearly. Opportunities more often.

Elevate commercial models with precision and speed using AI-driven analytics and technology that illuminate hidden insights in data.

COMMERCIALIZATION OVERVIEWCommercialization Quick Links

Service driven. Tech-enabled. Integrated compliance.

Orchestrate your success across the complete compliance lifecycle with best-in-class services and solutions for safety, regulatory, quality and medical information.

COMPLIANCE OVERVIEWSafety & Regulatory Compliance Quick Links

Intelligence that transforms life sciences end-to-end.

When your destination is a healthier world, making intelligent connections between data, technology, and services is your roadmap.

TECHNOLOGIES OVERVIEWTechnology Quick Links

CLINICAL PRODUCTS

COMMERCIAL PRODUCTS

COMPLIANCE, SAFETY, REG PRODUCTS

BLOGS, WHITE PAPERS & CASE STUDIES

Explore our library of insights, thought leadership, and the latest topics & trends in healthcare.

DISCOVER INSIGHTSTHE IQVIA INSTITUTE

An in-depth exploration of the global healthcare ecosystem with timely research, insightful analysis, and scientific expertise.

SEE LATEST REPORTSFEATURED INNOVATIONS

-

IQVIA Connected Intelligence™

-

IQVIA Healthcare-grade AI™

-

Human Data Science Cloud

-

IQVIA Innovation Hub

-

Decentralized Trials

-

Patient Experience powered by Apple

WHO WE ARE

- Our Story

- Our Impact

- Commitment to Public Health

- Code of Conduct

- Environmental Social Governance

- Privacy

- Executive Team

NEWS & RESOURCES

Unlock your potential to drive healthcare forward

By making intelligent connections between your needs, our capabilities, and the healthcare ecosystem, we can help you be more agile, accelerate results, and improve patient outcomes.

LEARN MORE

IQVIA AI is Healthcare-grade AI

Building on a rich history of developing AI for healthcare, IQVIA AI connects the right data, technology, and expertise to address the unique needs of healthcare. It's what we call Healthcare-grade AI.

LEARN MORE

Your healthcare data deserves more than just a cloud.

The IQVIA Human Data Science Cloud is our unique capability designed to enable healthcare-grade analytics, tools, and data management solutions to deliver fit-for-purpose global data at scale.

LEARN MORE

Innovations make an impact when bold ideas meet powerful partnerships

The IQVIA Innovation Hub connects start-ups with the extensive IQVIA network of assets, resources, clients, and partners. Together, we can help lead the future of healthcare with the extensive IQVIA network of assets, resources, clients, and partners.

LEARN MORE

Proven, faster DCT solutions

IQVIA Decentralized Trials deliver purpose-built clinical services and technologies that engage the right patients wherever they are. Our hybrid and fully virtual solutions have been used more than any others.

LEARN MORE

IQVIA Patient Experience Solutions powered by Apple

Empowering patients to personalize their healthcare and connecting them to caregivers has the potential to change the care delivery paradigm. IQVIA and Apple are collaborating to bring this exciting future of personalized care directly to devices patients already have and use.

LEARN MOREWORKING AT IQVIA

Our mission is to accelerate innovation for a healthier world. Together, we can solve customer challenges and improve patient lives.

LEARN MORELIFE AT IQVIA

Careers, culture and everything in between. Find out what’s going on right here, right now.

LEARN MORE

WE’RE HIRING

"Improving human health requires brave thinkers who are willing to explore new ideas and build on successes. Unleash your potential with us.

SEARCH JOBS- Blogs

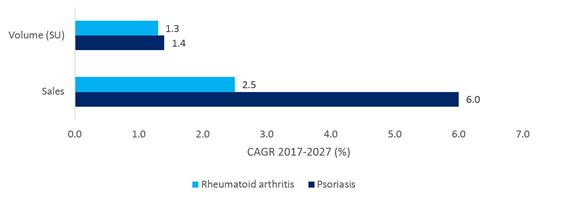

- Psoriasis drives autoimmune sales growth

Patient volume unchanged

The size of the patient population for this disease has been a driving factor for investment, with an estimated prevalence range of 0.5% up to 11% in some populations (Michalek et al., 2017), compared to rheumatoid arthritis prevalence of just 0.5-1% (Gabriel, 2001). However, as shown by the below graphic, the volume of the market is expected to show modest growth, which is in line with the rest of the prescription market over the next 10 years. It is the large forecast growth in sales, driven by expensive biologic therapies that sets this disease apart.

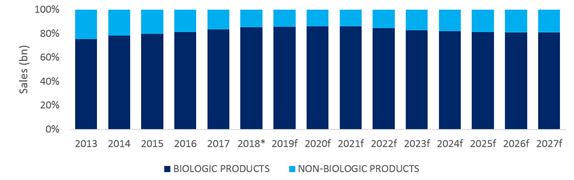

Confidence in biologic therapy for psoriasis recovered

The uptake of biologic therapy was comparatively slow in Dermatology initially, likely influenced by the issues seen with the first biologic for psoriasis, a CD11a inhibitor. This injectable treatment was launch in 2003 but subsequently removed from the market in 2008 due to serious side-effects, leaving Dermatologists sceptical of novel target biologics. The TNF inhibitor biologics have since proven the safety and efficacy of biologic treatment in psoriasis, despite the need for higher dosing than other autoimmune diseases at times, and uptake has been steady for this disease.

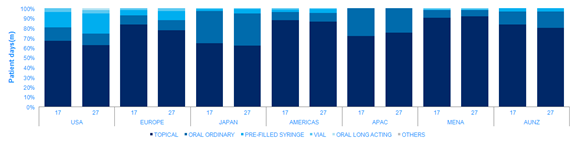

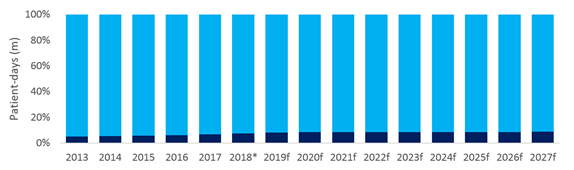

Biologic use in a small proportion of patients

Many of the large psoriasis patient pool goes untreated. Within the treated population IQVIA volume data suggests that 80% of the comparative prescription drug volume (patient days) is for topical therapies, leaving 20% of the patient days for a form of systemic treatment in 2017. Patients often use treatments in combination, so it is important to note that the patient days metric does not translate directly to patient numbers.

The use of systemic treatments does vary by region, driven by both prescribing habit and patient access to the more expensive treatments. Europe, the Americas and MENA show higher proportional use of topical therapies.

IQVIA data suggests that an even smaller proportion of patient days, just under 8%, were for a biologic therapy in 2017, as shown in the graphics below.

The below forecast models switching of patient volume to new launches from existing biologics, but if just a small proportion of currently topically treated patients, also receive a new biologic, the size of this market could grow considerably more. The below graphic also shows how the proportion of sales for biologic therapies is eroded over the forecast period by biosimilar launches, and novel oral kinase and PDE4 inhibitors.

* 2018 contains Q3 2018 historical data.

Now a new generation of Dermatologists and a new generation of biologics combine to show the events of a decade ago no longer shape prescribing. The market looks set to show significant sales growth as patients gain access to more of these highly effective treatments, and the effect is expected to spread to other dermatologic disorders as biologic treatments launch in areas such as atopic dermatitis.

For more information on brand and country specific forecasts in any disease, please contact IQVIA and request a demonstration of Forecast Link, an online tool containing 5 years historical and 10 years of forecast data in 73 countries, for 10,000 drugs and over 600 diseases.

References:

Michalek IM, Loring B, John SM. A systematic review of worldwide epidemiology of psoriasis. J Eur Acad Dermatol Venereol. 2017 Feb;31(2):205-212.

Gabriel SE. The epidemiology of rheumatoid arthritis. Rheum Dis Clin North Am. 2001;27:269–281.