- Library

- Channel Preference Versus Promotional Reality

Get instant access

Gareth Dabbs, Principal, Technology Solutions, IQVIA

Sarah Rickwood, Vice President, European Thought Leadership, IQVIA

Alexandra Smith, Analyst, European Thought Leadership, IQVIA

Christopher Wooden, Vice President, ChannelDynamics™, IQVIA

Introduction

One of the oldest commercial models is extensive use of sales representatives, working face to face with individual clients. This model, while eroded or vanished in many industries such as consumer goods or financial services, remains strong in pharma, despite well-established challenges.

For decades increasingly dominant payer power and promotional restrictions have challenged the classical model of the pharmaceutical sales rep visiting individual doctors, but it has proven remarkably resilient. The total number of reps the pharmaceutical industry employs has stayed quite steady at between 400,000 and 500,000 equivalents globally.1

The most fundamental challenge to the traditional sales model, however, has been more recent. The rise of digital technologies, enabling the growth of Multichannel, revolutionises the commercial model in ways other trends have not, because digital simultaneously dramatically diversifies the channels of communication and also sources of information. It is also, fundamentally, customer led.

Healthcare professionals, like the patients they treat, moved online – to seek information, communicate with peers, and to make healthcare decisions. Pharmaceutical companies have followed them.

The rise of digital technologies, enabling the growth of Multichannel, revolutionizes the commercial model in ways other trends have not

The rise of digital channels

The developed major markets, US, top 5 Europe and Japan account for over 85% of the first five years of sales (normalised, value) of New Chemical Entities2, the innovative drivers of research based pharma. Unsurprisingly, these countries are the focus of pharmaceutical company promotional spend.

However, our IQVIA ChannelDynamics™ audit of pharmaceutical promotional and communication activity shows that the rise of digital and multichannel has been far from uniform across major countries. In previously published white papers3, we’ve seen that Japan leads the world in terms of pharmaceutical company use of digital channels to communicate with healthcare professionals (HCPs), and the US has followed with a strong rise in the importance of digital, and therefore multichannel diversity.

Europe, which is the second key region for New Chemical Entity sales, and therefore crucial for promotional investment, lags on digital share and multichannel diversity. However, if we break Europe into countries, the picture is more mixed: some countries, Poland leading, have high digital volume shares. In others, the sales force still dominates promotional activity.

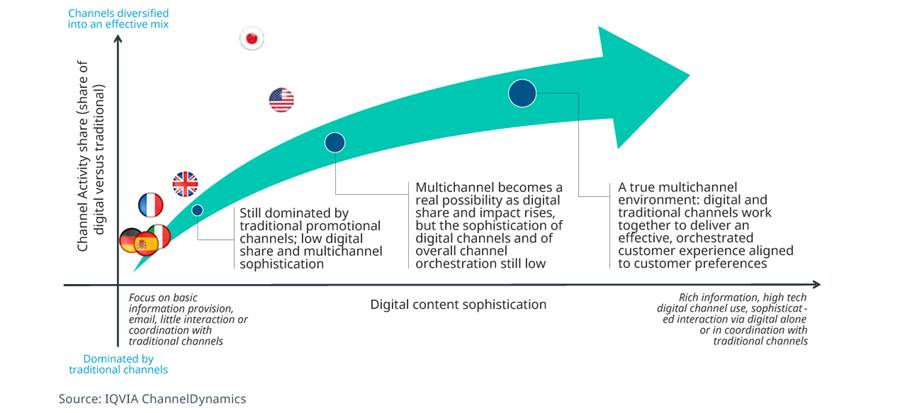

The rise of digital communication is a global phenomenon. Doctors across all these three regions are in sophisticated countries with access, at home and work, to the necessary digital infrastructure. The very different levels of multichannel maturity, shown schematically in Figure 1 but backed by a wealth of objective data and empirical observation, are driven by the “soft” factors – HCP culture and preference on the one hand – on the other, pharmaceutical company culture and established practices.

Nevertheless, whilst there are multiple speed lanes towards multichannel maturity, there’s only one direction of travel, as real world time for communication between HCP and pharmaceutical companies diminishes, and the proportion of time spent in the virtual world grows. Understanding if there is a disconnect between what HCPs want and expect in terms of channels of communication from pharmaceutical companies and what pharmaceutical companies are actually supplying them with is at the heart of making Multichannel a success.

Our IQVIA ChannelDynamics™ audit of pharmaceutical promotional and communication activity shows that the rise of digital and multichannel has been far from uniform across major countries

Figure 1: The key developed markets are at very different stages of multichannel maturity

NO COUNTRY, AS A WHOLE, HAS A TRULY MATURE MULTICHANNEL ENVIRONMENT, ALTHOUGH INDIVIDUAL CAMPAIGNS MAY BE

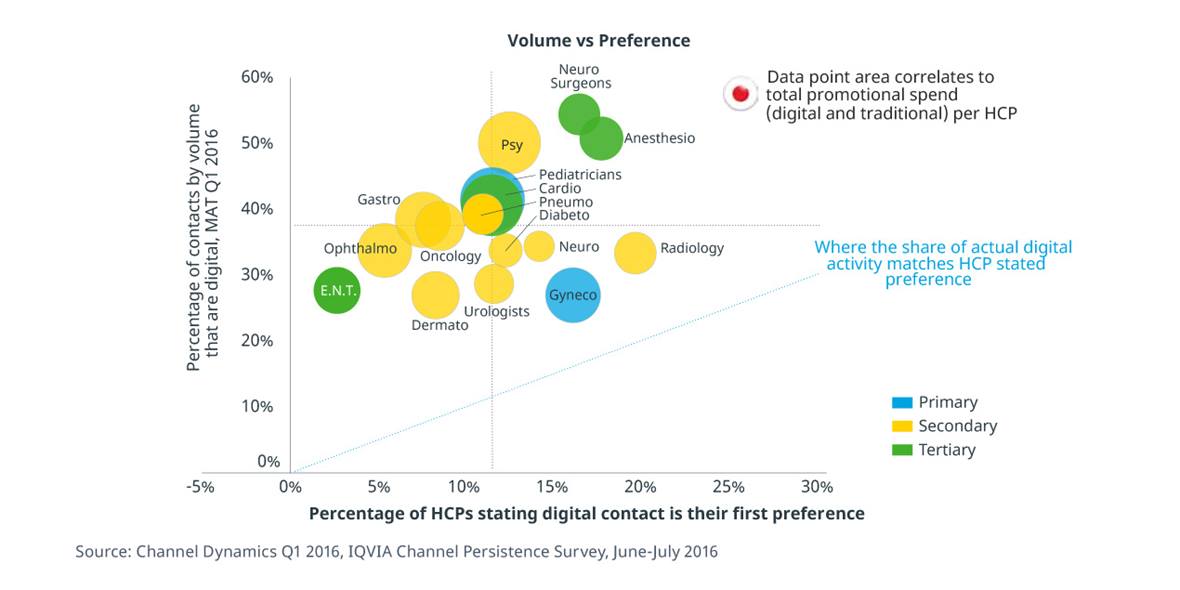

Understanding channel preference

Using the ChannelDynamics™ survey instrument, IQVIA has surveyed a very broad range of HCPs across 35 countries to ask them what channels they most prefer pharmaceutical companies to use to communicate with them. We analysed these responses versus the reports the same HCPs made of the channels that pharmaceutical companies actually used to communicate with them. Our findings show that disconnect between what HCPs say they want in terms of channels and what they get is much more common than convergence, but also that the picture’s hugely variable by country, and by type of healthcare professional.

It’s worth stating at this point that what HCPs say they want, in terms of channels of communication, should not necessarily be what they get, for optimal communication and indeed for optimal impact from a pharmaceutical company perspective. We can classify the functions of communication into four main areas: to generate awareness, to provide depth information, to build relationships, and to receive feedback. Email or journal advertising’s strength is in generating awareness; only an interactive channel can receive feedback, and until recently Pharma/HCP relationships were built primarily on real world contact. It’s important to note that our survey still shows that most healthcare professionals in all markets state their first preference remains for face to face interaction with pharmaceutical companies, mostly rep interaction.

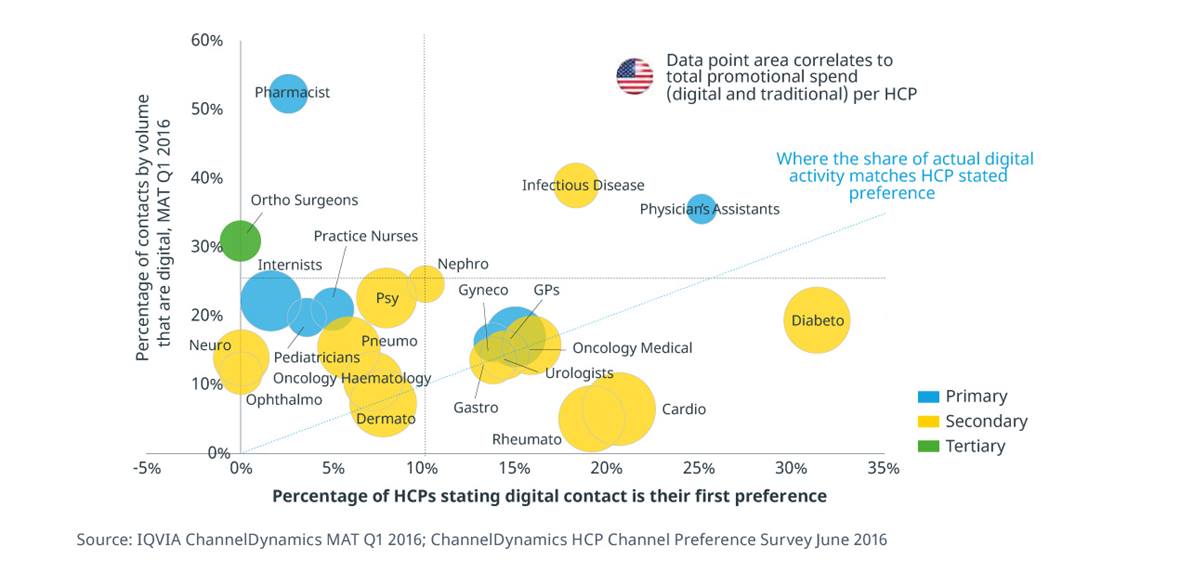

However, what we are seeing is a significant minority of healthcare professionals – in some cases, over one third of a particular group in a specific countries (for example, 33% of Italian diabetologists, 37% of German cardiologists) state that their very first preference for communication from pharmaceutical companies is digital.

Further, many HCPs in our survey have stated preferences for digital contact that far exceeds what they actually receive – is this in fact a signal that they feel “over-contacted” face to face and want to dial back face to face communication? Do they feel that digital channels may fit better with the time pressures they experience on their jobs? Pharmaceutical marketeers may want to be sensitive to such signals, but not necessarily to act to the degree suggested by the reported preference if the HCPs are in a crucial, competitive promotional area. Interpreting the rush of data on the way HCPs engage, separating the signal from the noise, and then acting to create the most effective multichannel experience by HCP and country will be the key challenge of multichannel for the next decade.

This could be an example of how surveying channel preference is uncovering an expression of saturation on the part of these doctors: they’d like to see less face to face, and seek more of their information on line. Given these specialties see amongst the highest promotional spend per doctor, is there a case for the industry to achieve greater efficiencies by listening and responding to what the doctors say they prefer?

Of course, in highly competitive disease areas the countervailing argument will always be that a company cannot afford to lose share of voice in face to face detailing – but what might be the benefits to the first mover which adjusts their channel mix in an intelligent manner? Better customer insight would help. On the other side of the line, there are outlier healthcare professional groups where the clear statement appears to be precisely the opposite: they experience far more digital channel communication than they want. This includes groups such as pharmacists and practice nurses where we are most likely seeing the impact of an understandable pharmaceutical industry policy of using lower cost channels to provide essential information to groups with lower decision making power over prescriptions.

Here the maxim that what healthcare professionals want should not necessarily be what they get might kick in: the most expensive resources of sales representatives must be allocated wisely. But again, is there a way to ensure that these groups aren’t perceiving a lack of face to face contact as a lack of relationship? What is it they think they could receive from more traditional contacts they don’t get from their digital interactions? Again, better customer insight would help.

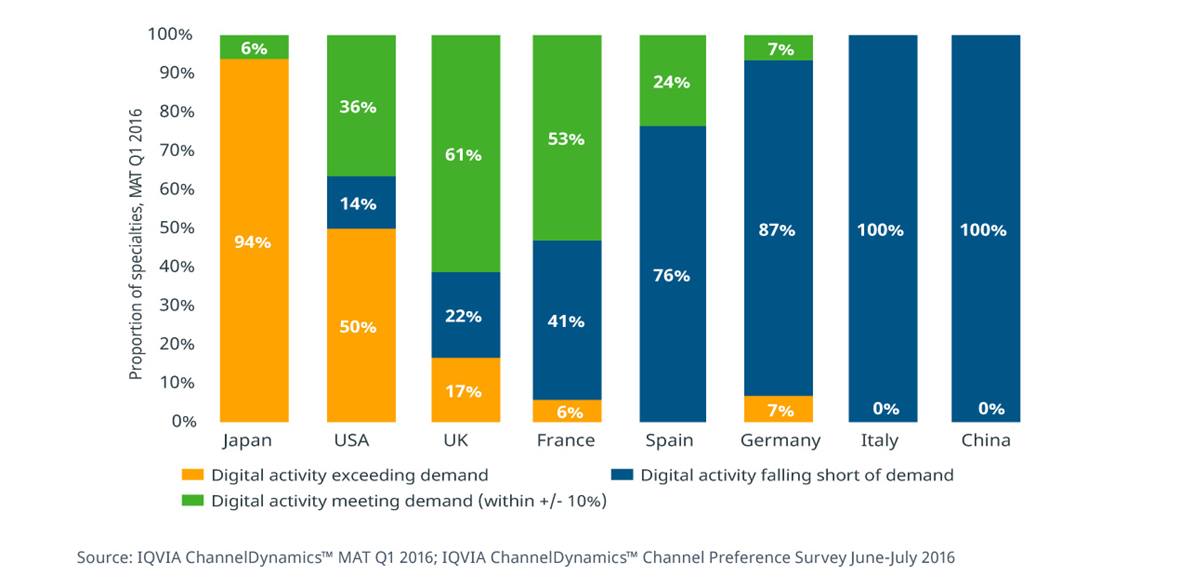

We expanded this analysis to a wider group of eight countries which represent some of the key markets out of the full ChannelDynamics™ coverage of 33. We divided healthcare professional groups into three:

- Those groups who received a volume share of digital communication in proportion to their reported preference – these were the HCP groups 10% above or below the line of equality, marked as green in the bars of Figure 3.

- Healthcare professional groups where the actual volume share of promotion that is digital is significantly higher than stated preference (more than 10%) are coded red;

- Those for which the actual digital volume is significantly lower than stated preference (less than 10%) are coded blue.

Figure 2: Many US healthcare professionals get greater digital contacts share than their preference suggests

Volume vs Preference

Three key findings from this analysis

Variability of digital preference and digital activity Digital preference varies widely, across countries and between HCP groups within countries. This should not surprise: as Figure 1 shows, the share and impact of digital promotional activity, by volume, is widely variable across the developed country markets which constitute the majority of promotional activity. Japan is the most advanced country in terms of digital activity – digital volume share grew earliest and is highest globally. The US, perhaps unsurprisingly, is next. Europe, however, lags the US and Japan, with few country exceptions, in terms of digital share and impact. Of the lead five countries only the UK shows significant digital share.

Figure 3: Healthcare professionals would prefer more digital interaction than they receive in 5/8 countries

PROPORTION OF SPECIALTIES RECEIVING THEIR PREFERRED AMOUNT OF DIGITAL ACTIVITY

Digital saturation?

The points of immediate interest lie at the extremes:

Japan, the most digitally advanced in terms of share, and the US, with the second highest share, show digital saturation – the majority of HCP groups would prefer less communication via digital channels. Has the pendulum swung too far on digital share, or is there a reaction to how digital channels are being used that can be addressed?

Digital potential?

At the other end of the spectrum, European countries with low levels of digital maturity are Italy, Spain, Germany, and France. In these countries, the traditional promotional model still rules; digital channels are a very low share of all channel activity, by volume. What is striking, therefore, is that the majority of healthcare professional groups express a strong preference for more use of digital – what’s driving this preference, and what are the barriers to meeting this demand for digital channel activity?

Has real customer insight been lost in our digital world?

Our survey, encompassing all major country markets (33 in the wider survey) and a key selection of HCP specialties, paints a picture of widespread suboptimal digital channel use. Where digital channels have become mainstream (Japan, US, UK to a certain extent), many groups of healthcare professionals state they prefer non-digital channels. Where healthcare professionals are asking for more communication via digital channels, as in Italy, France, Germany, Spain and (as one example of an emerging market country) China, that demand is not being met. In both cases, we believe that the root causes include:

- sub-optimal or out-of-date customer insight, and

- failure to put customer feedback and insight at the heart of channel mix decision making

- pharmaceutical company organisational challenges.

The last five years saw an explosion of digital opportunity for pharmaceutical marketeers. Digital communication opportunities ballooned, and the audiences (healthcare professional, patient, healthcare provider, healthcare payer, general public) for which digital communication and information became a necessity multiplied.

In this generative phase of digital marketing, keeping abreast of the technological developments, introducing them into the quite traditional and often conservative commercial structures of major pharmaceutical companies, and doing so across a wide range of very disparate country markets were, in themselves, major and time consuming tasks. And, as they consumed time, we believe they pushed marketing focus away from the fundamental customer insight principles which hold true, regardless of channel. As multichannel marketing moves from an early, establishment phase and becomes a mainstream and more mature activity, it’s time to re-visit those fundamental principles in order to ensure that multichannel truly realises its promise.

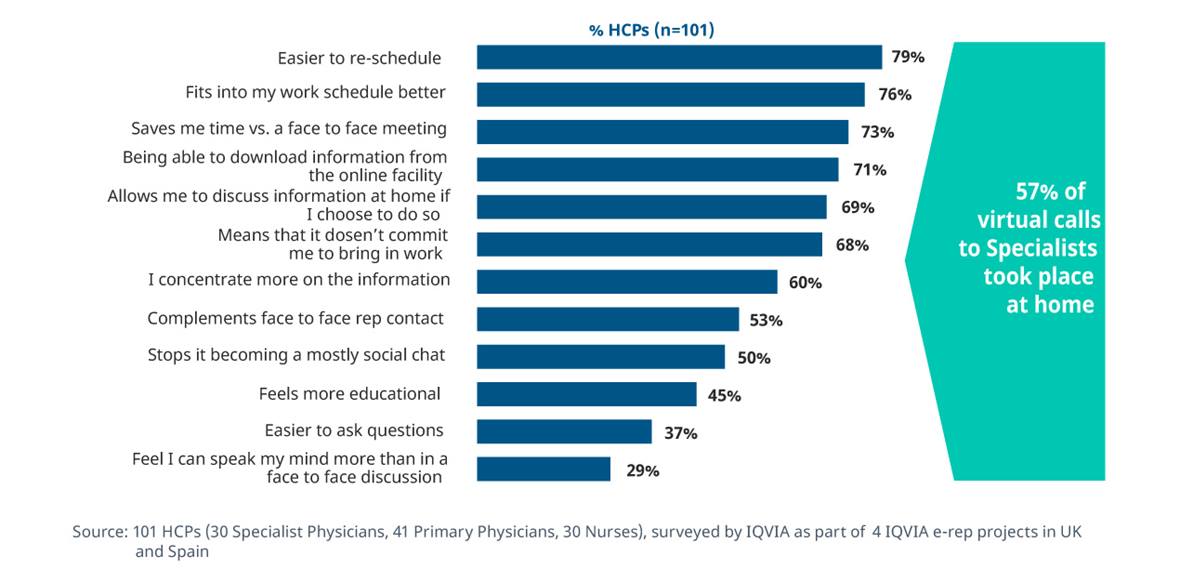

Figure 4: Key benefits of e-detail are ability to re-schedule and fit into work schedule

Q: WHAT ARE KEY BENEFITS TO YOU OF HAVING DISCUSSION WITH THE REPRESENTATIVE ONLINE & OVER THE TELEPHONE COMPARED TO A FACE TO FACE DISCUSSION?

Building the right role for digital in multichannel when healthcare professionals report a digital preference that is not currently met

Our research has uncovered an appetite from healthcare professionals in many countries for a greater level of digital communication with pharma than they currently get. This is important and positive news; it validates projects to drive a greater role for digital in multichannel mix. However, companies need to meet digital demand while simultaneously continuing to maintain promotional presence and impact and, crucially, ensuring that the sales teams, who will always be a core element of the mix, are on board with the digital journey. Accomplishing this requires both detailed insight of healthcare professionals as customers and of pharmaceutical companies’ own sales teams as enablers and users of digital channels. Companies must develop customer insight to

understand what drives healthcare professionals to want more digital interaction. When IQVIA undertook depth research on the reasons why HCPs in the UK and Spain like digital interaction, in this case specifically e-detailing, the findings, in Figure 4, were very clear – it is convenience and the ability to fit pharmaceutical company interaction into busy working lives that were especially valued. Digital channels are particularly effective here not just because they can be fitted into out of hours, spare moments and re-scheduled more easily, but because by their nature they are less about social interaction, more about information exchange, something that was also called out as a reason (although a smaller one).

In countries where digital activity is not meeting HCP demand, a key challenge is the perception of digital by the company’s own salesforce. It’s an unfortunate fact that sales representatives can see the adoption of digital channels as a threat, diluting and challenging their carefully built relationships with doctors, and even, potentially threatening their own roles. This is not helped when executives have, on occasion, sought to frame multichannel discussions in terms of RoI on digital versus real world interactions. Whilst that measure can be a tool, the correct focus must be on

the overall impact of a multichannel campaign with the right mix of all channels.

As one pharmaceutical executive who has lived through this process has commented to us, “to actually get the salesforce to trust you that you are not trying to replace their jobs is very hard”. The companies which have been most successful at growing digital with, not against, the activities of the salesforce are those that have developed salesforce as well customer insight and have used that insight to good effect. Sales representative naturally wish to keep their jobs, but they also want to be more effective and have a competitive edge on building and maintaining doctor relationships. Digital channels can be positioned as enablers of their roles, and their sales effectiveness. The companies which have been most effective in introducing a truly integrated multichannel model are the ones which take time to:

- Develop insight on their salesforce’s motivations: what do sales reps value which multichannel could help them achieve?

- Communicate to the salesforce on your customer insights: do they understand how they fit into the wider customer needs?

- Draw up an integrated plan for change – have the salesforce (or handpicked representatives) involved in leading the change. Start slowly; aim for incremental progress; regularly communicate early success stories to the wider sales team.

Figure 5: Preliminary findings – HCPs saturated with digital in Japan where use of digital is unusually high

NUMBER OF NEXT GENERATION BIOTHERAPEUTICS CURRENTLY MARKETED OR IN LATE-STAGE PIPELINE

Saturated country environment

Our research into the patterns of uptake and use of digital communication channels by doctors across different channels shows the very strong influence of culture and historical precedent. Japan is an example of a country with early adoption of digital portals, driven by the rapid rise of a small number of leading providers, where in some cases, small incentives in the form of vouchers were available to encourage doctors to go through e-details. This has undoubtedly encouraged digital activity; Japan has the highest share of digital channel activity in the world. However, our research also shows that impact of digital activity in Japan, in terms of how healthcare professionals report they will choose to change their prescribing after a digital contact, is less positive than in the US, and indeed the UK and Poland, other countries with high digital share. In addition, our research on channel preference demonstrates that regardless of their specialty, Japanese healthcare professionals report they’d prefer a lower level of digital communication than they are currently receiving, as shown in Figure 5.

The Japanese could be in a situation where the initial success of digital has resulted in overkill and saturation, a certain level of disenchantment with digital channels as they are currently presented. Certain multinational corporations have already challenged the status quo, moving from presence on the generally available doctor portals to creating their own portals where they have full control over the nature of the doctor engagement.

However, in a situation where digital share is so high, competitive pressure against dialing back digital activity would be intense, and there’s no guarantee it would (if used in isolation) be the solution. Japan’s an extreme example, but our research shows it’s not the only one – the US falls into this group and in other countries certain healthcare professional groups do – for example, in Germany, Internists report a higher share of digital than they would like, but other specialties report they would prefer more digital than they receive.

Companies faced with this situation need to understand what is driving their healthcare professional audience to devalue digital interaction. Is it the nature of the digital channel or platform that is being used? Is it the richness and relevance of the information that is being provided? Is it a sub-optimal mix between information provision and interactivity? What is clear is that achieving a high share of digital activity is not an end in itself and by no means the end of the journey to multichannel maturity; adjustments must be made continuously, and the basis of those adjustments is a highly effective collection of customer insight and feedback.

Customer insight, channel preference and orchestrated customer engagement

From our research, we can see that the journey to multichannel maturity is not over even in the most advanced countries or companies. Key questions that we answered are:

Significant differences in multichannel maturity remain across the developed markets which are the focus of most promotional value One of the visions of multichannel marketing is that a diversity of channels allows pharmaceutical companies to engage more healthcare professionals, more effectively, via their preferred channels. For digital at least, our research suggests that this does not happen in most countries, and the mis-match can occur both in those countries with strong digital share (Japan) and those with low digital share (Italy, Germany, China). More investment is needed in developing real customer insight into HCP motivations and preferences if multichannel is to mature into orchestrated customer engagement HCP channel preference is complex. Our research presented here demonstrates that the preference for one set of digital channels varies widely by HCP specialty and country. Other, depth work that we have done shows that a single physician’s channel preference can vary by the disease area for which they receive communication. How can companies, faced with such complexity, ever hope to master customer preference?

Here is the five point plan:

- Make your customer insight more personal and specific.

The “segment of one” concept has been over-used into cliché, but for pharmaceutical marketing it remains highly valuable, because, as launches tend increasingly to specialty with limited populations of patients and HCPs treating them, understanding those few, but highly valuable doctors, in depth is

essential. - Build an integrated picture of each HCP’s channel and relationship preference.

Make sure that the salesforce is a core element of this process and is fully informed of the feedback from other channels. Ensure that the full universe of relevant HCPs are covered, including those that are not accessible by salesforce. For HCPs with multiple relevant disease areas of interest, don’t assume that preference is uniform across therapy areas – build a picture by each. - Collect feedback and revise channel preference pictures continuously. Customer insight will be a complex, continuously developing picture.

Channels which were preferred and worked well in the past may be rejected by HCPs if over used or without effective content. Further, stated preferences are only a starting point; learnings from responsiveness to specific channel actions should be then used to adjust – where channels are inexpensive, as many digital channels are, the cost of experimentation is low and the rewards potentially high. - Use customer insight across all channels and all commercial team players.

Customer insight should be shared continuously and acted upon in a timely fashion, to help both marketing and sales make better channel targeting

decisions. A doctor may feedback that she does not want to see reps on a given mature therapy area any more – is she made aware of ways to keep in touch digitally if there’s news that’s relevant? - Measure activity and impact – and share feedback.

One of the key enemies to the development of digital channels and the journey to true multichannel maturity is the preconceptions of a pharmaceutical company’s own employees. Whether it’s a senior executive who does not wholeheartedly endorse multichannel initiatives or a sales representative who equates the introduction of digital with the loss of their job, outdated perceptions die hard and cause huge damage by their persistence. Feedback, on what their healthcare professional customers want, and what works in terms of channels is at the core of the journey to a truly effective multichannel maturity.

Conclusion

In the past, most pharmaceutical marketing functions have been fundamentally organised around equipping an internal customer (the sales rep); and most marketeers’ effort has been focussed on developing a sales aid, checking if ‘their’ messages were resonating, and that the reps were doing as instructed.

In contrast, today’s pharmaceutical commercial function needs to be focussed on your external customers – the patient, the prescriber, and the payer – equipping them with the information they need (factual content), when they need it (channel choice), to make appropriate prescribing decisions and ensure optimal use of treatment and to achieve treatment goals.

This is quite a change: we are in the process of remaking a model which was five decades or more in creation, and what is more changing it in just a few years, and so it is unsurprising pharmaceutical companies struggle with the degree of transformation and capabilities to make it happen. In the end, it’s not the technology that will be transformational agent, but the attitudes and beliefs of the Pharmaceutical marketeers and sales people who make it happen.

References

Source:

- IQVIA ChannelDynamics™, Global Rep equivalents measured

- IQVIA analysis of the sales of 120 New Chemical Entities, using normalised sales for each country and showing

- the country by country share of aggregate NCE sales

- 3 myths of Multichannel Marketing IQVIA, 2015), The Essential European Revolution (IQVIA, 2016)